Dive Brief:

- Pickup-only grocer JackBe, which opened its first location in Oklahoma City earlier this year, announced last week it has raised $11.5 million in new funding.

- The startup said it plans to use the funding to fuel expansion, with plans to open two more locations in the area and eventually expand to additional communities.

- Despite these gains, pickup-only stores run by startups and companies like Walmart have either shut down recently or failed to expand as consumers prioritize in-store shopping.

Dive Insight:

During the height of the pandemic, pickup-only grocery stores had an undeniable appeal as outlets where consumers could grab orders while making minimal contact with other people. Mainstream grocers like Kroger and Raley’s even briefly converted a few locations to the pickup-only format.

But the decisive return of in-store shopping over the past year has leveled a significant challenge to companies that look to continue running these stores dedicated to online ordering. E-commerce demand, while still strong, has come down considerably from early in the global health crisis, with the latest forecast from Brick Meets Click and Mercatus projecting roughly 12% annual growth through 2027.

Meanwhile, thousands of stores that welcome shopper foot traffic are continuing to expand their pickup and delivery services, making it harder for sites dedicated to e-commerce to stand out.

Walmart and Amazon both opened locations dedicated to online ordering before the pandemic hit. The formats failed to take flight, however, and over the past few months, Walmart has closed its two remaining locations while Amazon has closed one of its two Amazon Fresh Pickup locations in Seattle.

Startups haven’t fared much better. Opie, which opened its first “drive-thru grocery” in South Carolina in fall 2021, still just operates one location despite plans to expand. In Chicago, Fresh Street opened its pickup-only store last year but has since shifted to a B2B distribution model.

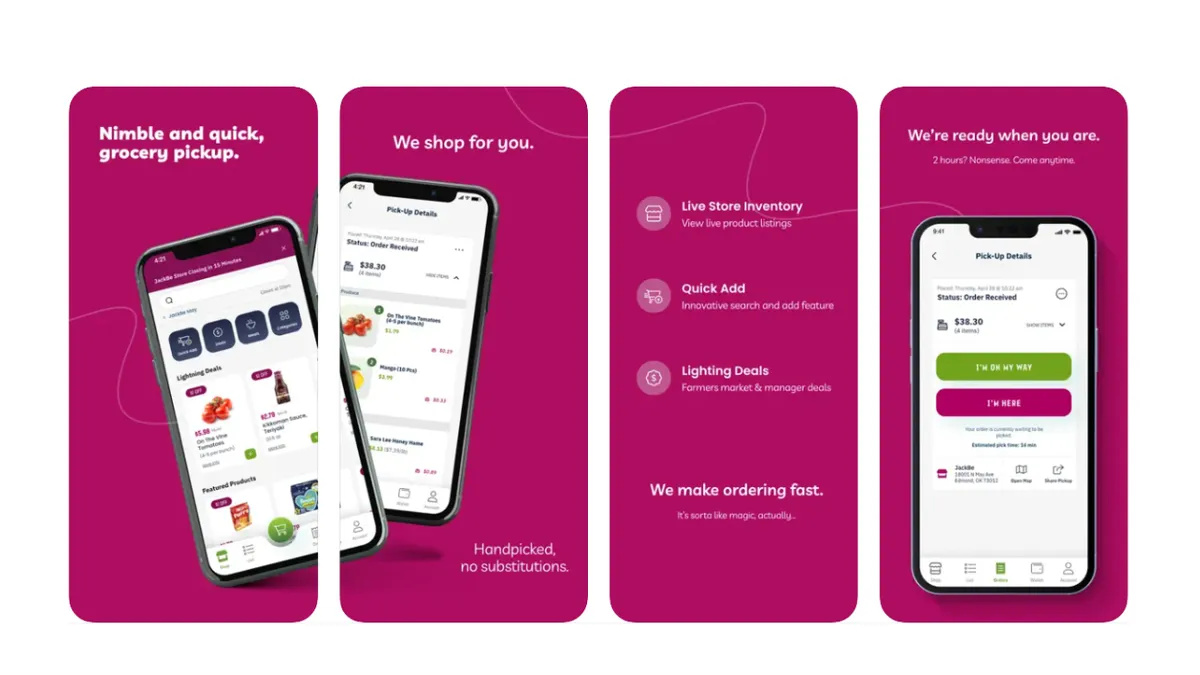

JackBe touts several features that it says distinguish it from other grocers, including a guarantee that orders will not contain any product substitutions. The startup claimed in early March that 55% of shoppers who placed an order in the store’s first weeks of operation ended up returning.

Product substitutions have certainly proven to be a sore spot for online shoppers. Grocers, as well as online marketplaces like Instacart, are taking steps to improve the problem through added transparency and smarter, AI-driven product swaps.

Pickup-only grocers like JackBe and Addie’s, another startup that recently opened in Massachusetts, will have an uphill battle to win over shoppers used to frequenting the stores — and online shopping channels — of mainstream grocers and discount players, particularly as inflation-weary shoppers continue to prioritize low prices.