Dive Brief:

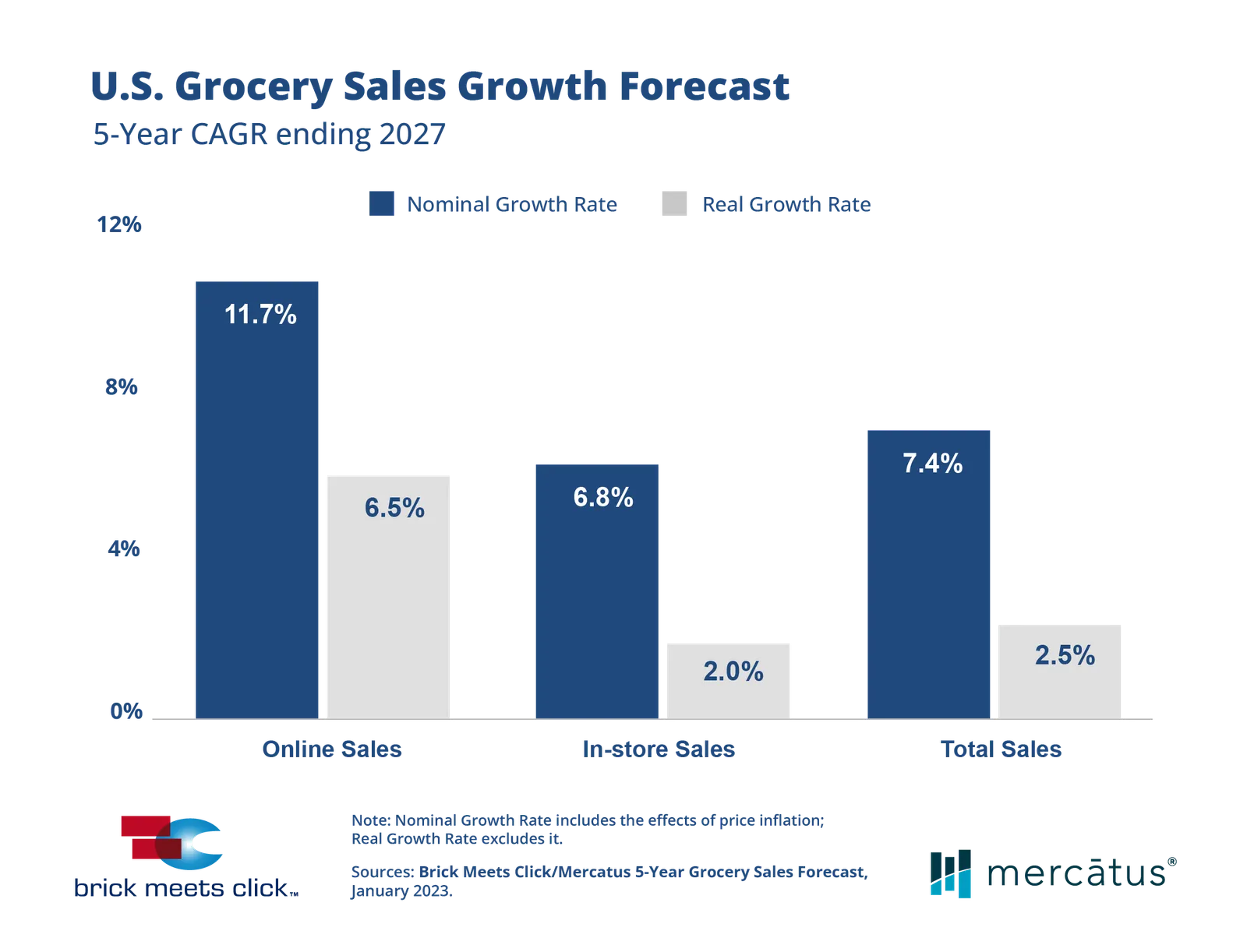

- Over the next five years, online grocery sales will see a compound annual growth rate (CAGR) of 11.7%, bumping e-commerce’s share of overall grocery spending from 11.2% in 2022 to 13.6% in 2027, per a newly released forecast by Brick Meets Click and Mercatus.

- Among fulfillment methods, pickup is predicted to have the fastest growth and biggest market share gain over the next five years, with a 13.6% CAGR. By 2027, that method is expected to account for more than half (50.3%) of online grocery sales, up from 45.4% in 2022, stealing share from ship-to-home and delivery.

- While the forecast has online grocery sales slowing after a rapid growth spurt during the start of the pandemic, ongoing inflationary and health concerns are expected to continue to impact e-commerce usage.

Dive Insight:

The Brick Meets Click and Mercatus forecast paints a more modest picture of grocery e-commerce’s expected growth in comparison to predictions made in 2020 about the future of online grocery sales.

Those included a prediction from Mercatus and research firm Incisiv that e-commerce would account for 21.5% of total grocery sales, worth $250 billion, by 2025 and a forecast from FMI and Nielsen that online food and beverage sales would hit $143 billion by 2025 and represent 30% of all omnichannel food and beverage spending.

The newest Brick Meets Click and Mercatus forecast predicts e-commerce will increase a modest 2.4 percentage points over the next five years, underscoring the challenges retailers face in balancing sales with profitability. The firms noted that ongoing health concerns from COVID-19 and other illnesses will likely continue to encourage online grocery shopping.

Excluding price inflation, overall grocery sales are expected to grow at a 2.5% CAGR by 2027, primarily due to an increase in household spending, followed by a gain in the number of households shopping for groceries, per the forecast from Brick Meets Click and Mercatus. However, the aging U.S. population and shrinking household size are both expected to weigh down grocery sales.

Price inflation is predicted to serve as a larger growth driver for in-store shopping while having a smaller influence on fueling online sales.

The forecast predicts average order values and order frequency will increase, with pickup accounting for the most growth across both metrics followed by delivery and ship-to-home service.

Pickup’s bright forecast is supported by predictions that the fulfillment method will become more widely available across the country.

“Delivery is already saturated, with most customers having the choice of multiple home delivery options across a wide range of retail banners,” the firms stated in their report, noting that delivery usage is more sensitive to financial and health concerns than pickup.

Going forward, figuring out the profitability of grocery e-commerce will be key for retailers, said David Bishop, partner at Brick Meets Click.

“Now more than ever, grocers need a grounded view of the future market while simultaneously strengthening the customer experience to protect their base business and improving the profitability of this higher cost-to-serve mode of shopping,” he said in a statement.