With the Kroger-Albertsons’ store divestiture plan unveiled last week, C&S Wholesale Grocers is preparing to more than triple its footprint of retail locations.

In the proposed $1.9 billion deal, C&S has agreed to buy 413 stores spread out across 17 states and Washington, D.C., from the grocery giants. The deal includes the sale of the QFC, Carrs and Mariano’s banners to C&S as well a licensing arrangement that would allow C&S to use the Albertsons brand name in Arizona, California, Colorado and Wyoming, according to announcements from the companies.

In addition, the agreement allows Kroger to require C&S to purchase up to 237 additional stores as part of the effort by Kroger and Albertsons to satisfy regulators reviewing their proposed merger

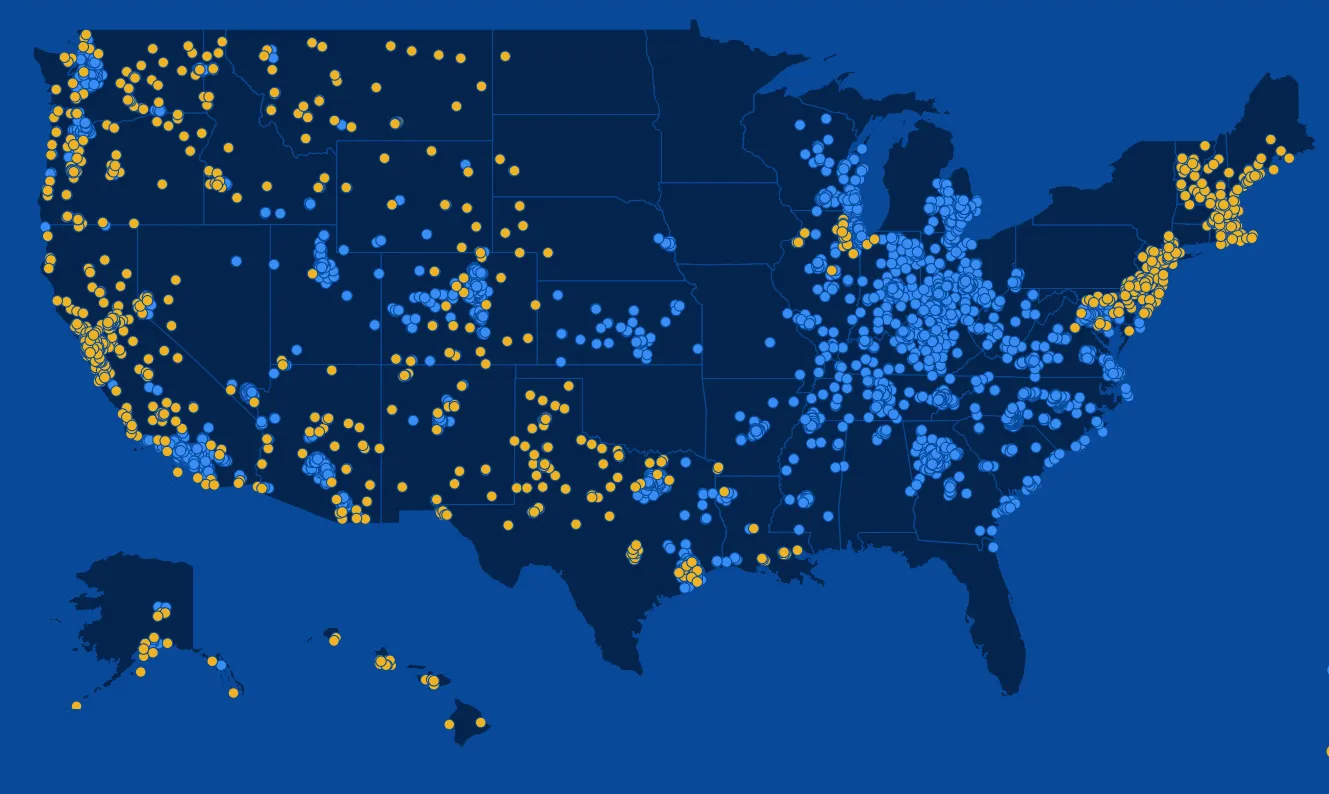

Kroger and Albertsons each operate more than 2,000 stores across the U.S. The grocers, which currently compete in multiple markets, published a map showing where their retail footprints are:

Albertsons and Kroger’s store fleets overlap heavily in several markets across the U.S.

The divestiture plan with C&S focuses mainly on Western states — a part of the country where the two grocers have significant overlap with their store fleets.

States included in the Albertsons-Kroger store divestiture plan

If the proposal gets regulators’ seal of approval, it would transform C&S from a regional grocer into a national player, putting its store count on par with Whole Foods Market and Trader Joe’s.

C&S currently operates corporate stores and services independent franchisees under the Piggly Wiggly banner and also runs 11 Grand Union stores in New York and Vermont — totaling roughly 160 locations in its retail portfolio.

“[W]e will be in a unique position as a leading wholesale supplier and retailer to help grow their business and continue our legacy of braggingly happy customers,” C&S Chief Operating Officer Eric Winn, who becomes the company’s CEO Oct. 2, said in a statement about the deal.

Currently, the bulk of C&S’s stores are in Wisconsin and South Carolina, where the company operates 90 and 46 stores, respectively, under the Piggly Wiggly banner, according to the company’s website.

Under the plan, C&S would pick up the most stores (104) in Washington state — accounting for almost a quarter of the divested stores.

Here’s how C&S’s store count by state would look if the company adds the 413 stores it has agreed to acquire to its existing retail portfolio:

Washington would have the most C&S stores if the $1.9B deal gets approved

Illinois is the only state where C&S currently operates retail locations and plans to pick up divested stores. While the announcements said C&S would buy 10 locations in the Washington, D.C., metro area, it’s unclear how that store count would break down.

While some industry observers have questioned how successful C&S could run a massively expanded retail footprint, C&S pointed to its previous experience nabbing divested stores when the $1.9 billion deal was announced.

As part of the Price Chopper-Tops Market merger in 2021, C&S agreed to acquire 12 divested Tops supermarkets. C&S rebannered the Tops stores under the Grand Union name.