Dive Brief:

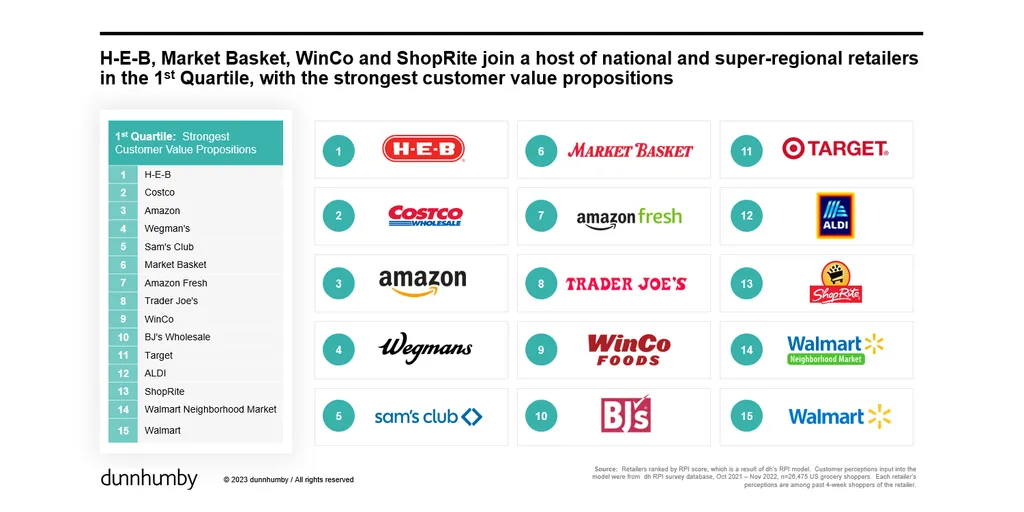

- H-E-B landed in the No. 1 position in the 2022 Retailer Preference Index compiled by data analytics firm Dunnhumby, returning the Texas supermarket chain to the top spot after it finished in second place the year before.

- Amazon, which led the annual rankings in 2020 and 2021, took third place, while Costco jumped to No. 2 after finishing in the ninth spot in 2021. Wegmans remained in fourth place, and Sam’s Club came in at No. 5.

- The latest results reflect declining emphasis by consumers on speed when shopping for groceries as the pandemic has receded.

Dive Insight:

Dunnhumby’s findings over the past few years underscore the profound impact the COVID-19 crisis had on people’s priorities — and, by extension, the qualities they most valued among retailers.

Amazon soared ahead of the competition in the grocery sector as shoppers flocked to digital channels after the sudden onset of the pandemic, but the e-commerce giant lost ground during the past year as consumers placed less importance on time savings in evaluating retailers.

That shift paved the way for H-E-B to emerge as the nation’s top grocer in Dunnhumby’s index based in part on the chain’s strength in areas like “quality” and “price, promotions and rewards,” both of which are more significant now than they were before the pandemic, according to the research.

The index, which is based on a combination of opinions drawn from a survey of about 10,000 consumers conducted last November and retailers’ financial results, is designed to predict which grocers will perform best during the next several years. The rankings encompass 63 retailers that sell food and non-food household items, and include national and regional chains.

Other retailers occupying high-level spots in the rankings include Market Basket, Amazon Fresh, Trader Joe’s, Winco Foods and BJ’s Wholesale Club, which took spots 6 through 10, respectively.

H-E-B, Costco and Amazon are situated best for achieving long-term success based on the customer value propositions Dunnhumby believes will be most impactful going forward.

Dunnhumby concluded that non-traditional retailers and national chains like Target and Walmart did a better job of adapting to changing consumer demands between 2020 and 2022 than other retailers.

The index also indicates that despite their size, Kroger and Albertsons are facing key challenges as they look to compete with other retailers in the race to build customer loyalty. Kroger finished 21st in the index, while Albertsons secured the 47th slot on the list.

“A take-away from [the results] for Albertsons is perhaps they are over-investing in a seamless experience and saving customers time and should be shifting some of that focus toward investing in base prices, better promotions and in identifying the right assortment for their shoppers,” the report stated.

Dunnhumby also noted that club retailers have solidified their position over the past few years because of their reputations for providing value along with a dependable shopping experience, adding that none of those retailers finished higher than seventh place in 2019. In addition, Amazon remains the top online retailer in the grocery space, but other companies have made significant progress toward catching up, according to Dunnhumby.