Dive Brief:

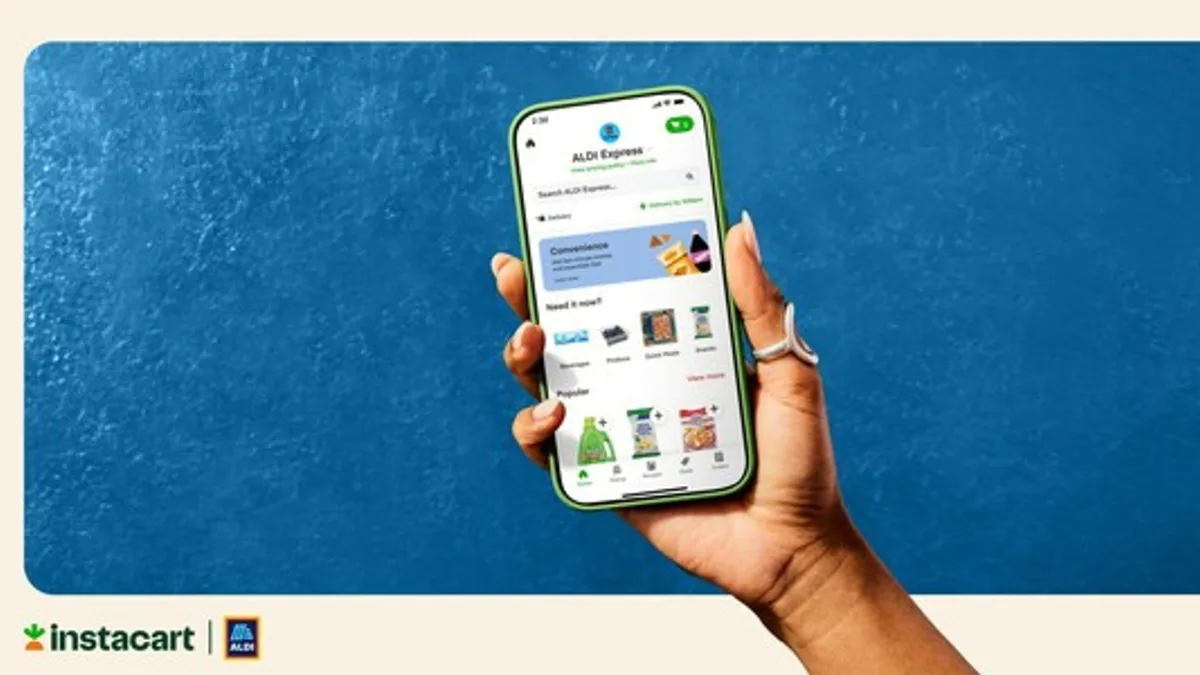

- Aldi and Instacart announced Thursday the launch of Aldi Express, a “virtual convenience store” providing 30-minute delivery of a selection of nearly 2,000 items.

- The Instacart-powered virtual store is available from over 2,100 Aldi U.S. locations and offers delivery of prepared foods, snacks, drinks, grocery staples, household essentials and other Aldi-exclusive items.

- Aldi continues to expand its e-commerce presence after recently launching its own online grocery shopping site and app.

Dive Insight:

With this launch, Aldi joins other grocery chains like Kroger and Publix in offering speedy delivery of convenience goods. The 30-minute service aims to fulfill a different shopping mission — the impulse or fill-in shop — instead of the full-basket trip that online grocery shopping has traditionally targeted.

Aldi Express also builds on an e-commerce partnership with Instacart that began in 2017, when the two companies began working together. Instacart currently delivers from over 2,200 Aldi locations and fulfills pickup orders from more than 1,500 stores.

In 2018, the e-commerce company added alcohol delivery from Aldi and, in November 2020, the grocer began accepting SNAP online payments through Instacart, according to the press release.

Even as it has added new Instacart services, Aldi has expanded its own online shopping options. The discount grocer launched its own e-commerce site and app, joining a growing chorus of grocers looking to own the online shopping experience, and the data that comes from it.

DoorDash added Aldi to its delivery portfolio in February, providing delivery services to 38 of the grocer’s U.S. stores.

Although competition and new proprietary retailer sites threaten to cut into Instacart’s marketplace traffic, the e-commerce provider has expanded its services to take advantage of its large gig workforce and tech prowess. In addition to the 30-minute delivery service, Instacart now sells smart carts, electronic shelf labels, digital insights and other capabilities.

Aldi released an expansive omnichannel growth plan at the beginning of 2022, which includes opening around 150 U.S. stores and expanding curbside pickup to an additional 300 locations. Last month, the grocer, which has seen heightened consumer interest amid record-high inflation, announced price cuts aimed at saving shoppers more than $60 million.

Convenience and rapid delivery hit a stride across the grocery industry at the peak of the COVID-19 pandemic, and in 2021 a slew of traditional grocery chains adopted the format, including Kroger and multiple Ahold Delhaize banners.

As shoppers return to pre-pandemic routines, companies like GoPuff that offer rapid delivery almost exclusively have scaled back considerably, offering an opportunity for grocers like Aldi to snap up market share in quick delivery.