Keeping costs down for consumers is paramount as the grocery industry ramps up e-commerce, Instacart CEO Chris Rogers said at the Goldman Sachs Communacopia & Technology Conference on Wednesday.

“Affordability is probably the biggest unlock to online grocery adoption. We know that it’s the No. 1 reason that people churn off of Instacart,” Rogers said, noting that affordability will be a “key lever” in retaining more consumers.

To that end, Instacart is working with its retail partners on their pricing strategies as well as integrating retailers’ loyalty programs and offering weekly flyers, said Rogers, who became CEO in mid-August after nearly six years with the grocery technology company, including three as its chief business officer.

While retailers decide how to price on Instacart, the grocery technology company is urging them to price at or just above in-store prices, Rogers said, noting that retailers that offer price parity outperform those that mark up prices on the Instacart platform.

“We’re going to really show the business case to retailers and show them the compelling reasons why they should do this and also just make sure that we’re educating them on the broader digital landscape,” Rogers said.

During the past 12 months, sales among price-parity retailers have grown, on average, 10 percentage points faster than among marked-up retailers, he noted.

“We’re also seeing on our platform that users that are shopping on price-parity retailers are retaining better, so the data is suggesting that this is a strategic move for our retail partners,” he said.

Earlier this year, Instacart announced that Schnuck Markets, Heritage Grocers Group and home improvement chain Lowe’s switched to price parity. Walmart Canada lowered its markup, as did Costco on its same-day delivery websites for the U.S. and Canada.

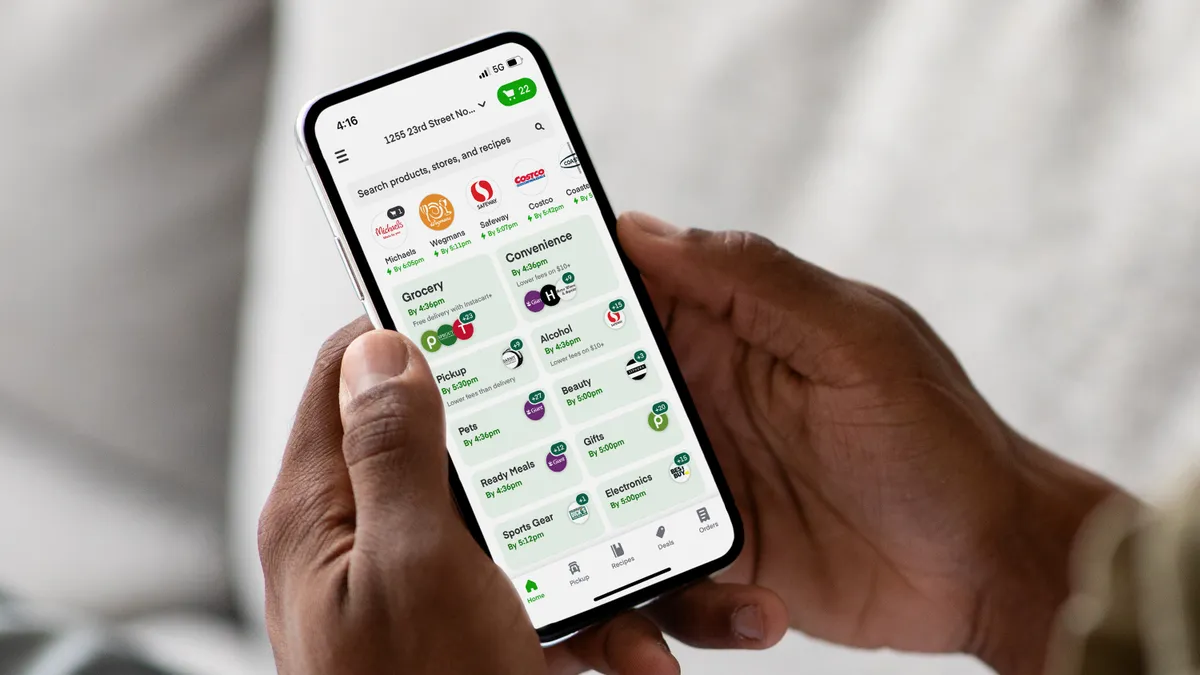

Instacart is testing merchandising tools within its app that highlight price-parity retailers, Rogers added.

The company is also focused on continuing the momentum with its enterprise platform. Instacart sees the opportunity to expand its tools for retailers’ sites beyond North America, Rogers said. The company’s acquisition earlier this year of e-commerce solutions provider Wynshop “kind of exposed the fact that there is real product market fit for our enterprise suite of products beyond [North America],” he said.

The final priority Rogers outlined for the company is accelerating its ads and data revenue as well as ramping up monetization of data through its newly launched Consumer Insights Portal.

“I had a retailer recently tell me that the amount that I’m writing them a check for the ads business is larger than the SaaS fee that they’re paying us for the storefront,” Rogers said, referring to the acronym for Software as a Service.

When asked about Amazon’s new same-day perishables delivery service, Rogers said Instacart has a competitive advantage because of its broader assortment with 17 million SKUs, fast delivery speeds and consumer trust in quality.

“We are going to use this as a rallying cry with our retailers,” Rogers said about the Amazon announcement.