Groceryshop aims to provide food retailers, suppliers and CPGs with insights to improve their relationships with customers as well as each other. This year’s annual conference was jam-packed with sessions about artificial intelligence, experiential retail and omnichannel shopping.

The show, which was held in Las Vegas earlier this week, tackled key questions around how grocers can serve shifting consumer behaviors, from the rise of shopping on TikTok to the increasing usage of GLP-1s. The show was a reminder that grocers need to stay nimble as they roll out digital innovation, new advertising capabilities and labor allocations in their quest to win over consumers.

Here are several key takeaways from this year’s conference.

The next phase of AI

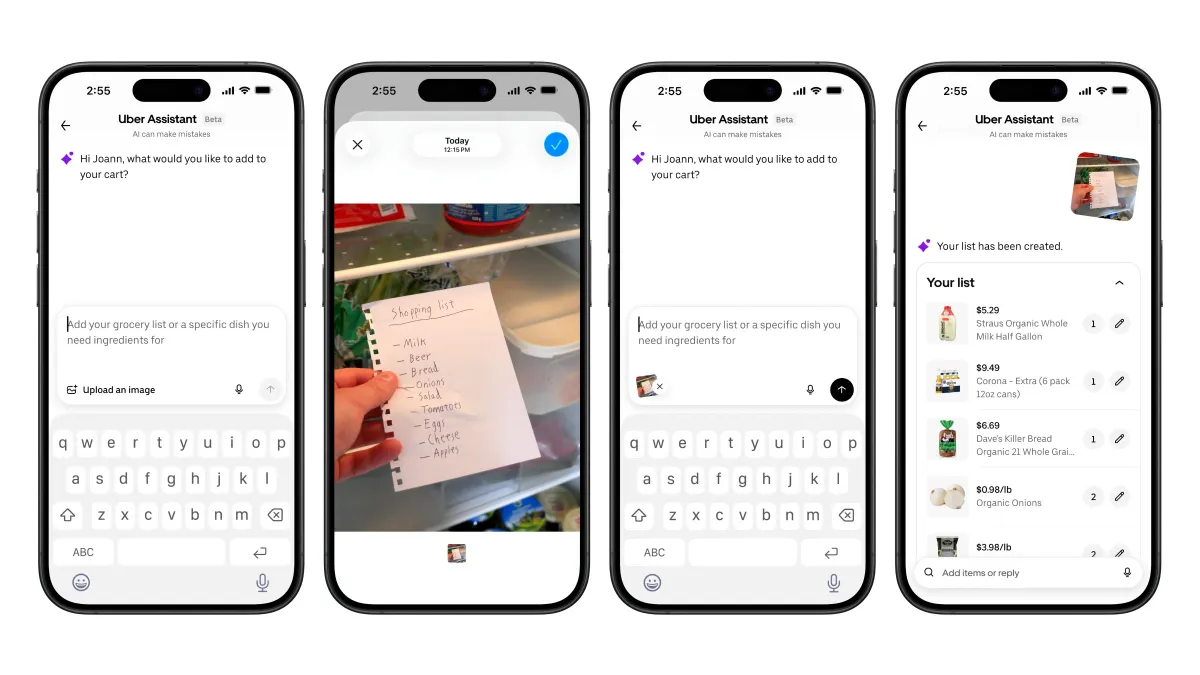

AI was one of the most talked-about technologies at Groceryshop this year, and agentic AI appears to be the next major focus area for the industry.

Agentic AI is a more solution-based AI system meant to accomplish specific goals with limited human involvement.

Some grocers are integrating this technology into their retail media operations. Bobby Watts, senior vice president and executive lead of AD Retail Media, said that Ahold Delhaize is currently working to use agentic AI as a “layer” over its retail media platform that will enable media planning and media activation for advertisers “with one click.”

Christine Foster, Kroger Precision Marketing’s senior vice president of commercial strategy and operations, said during a Groceryshop panel that agentic AI is helping the retail media unit unify its digital operations.

“[Agentic AI is] a big part of how we’ve prepared in terms of unification. So we can truly take the insight to activation and make sure that that is a seamless experience for brands, that they can have a business impact, an insight, and then take it through to how you can activate, how you can create loyalty with that customer,” Foster said.

In-store retail media is still going strong

In-store retail media is by no means new, but its importance has only grown in the past year. As retail media networks mature, grocers are seeing that their stores provide the best overview of their customers’ entire shopping trips. In-store shopping drives discovery, especially when retail media gets involved — and this is an opportunity grocers aren’t going to let slip away.

According to Foster, in-store retail media is still underutilized, noting that there is more work to be done to, for example, make in-store screens look and feel more native on shelves.

Liz Roche, vice president of Albertsons’ Media Collective, spoke in an interview about how the store is the opportunity to create full-funnel retail media experiences that connect with shoppers during every part of the shopping journey. She noted that the company is currently piloting an in-store digital screen network, which is so far resonating with shoppers as well as CPG partners.

“E-commerce is booming and digital is growing, but that want and that need to go to the store, it just doesn’t go away,” Roche said.

Grocers can’t overlook “intentional shoppers”

Grocers unsurprisingly touted their efforts to attract budget-conscious shoppers, from Whole Foods Market’s “sea of yellow” sale tags to Lidl’s ongoing cost-cutting initiatives. But grocers need to be mindful about catering to another cohort of customers — what Giant Eagle’s chief merchandising and marketing officer calls “intentional shoppers.”

“Our customers are becoming more intentional in what they do. GLP-1s are making them more intentional around nutrient-dense products,” Weinstein said during a Tuesday session, noting that there’s a prime opportunity for retailers to cater to the health-focused needs of this shopper demographic by integrating pharmacy and grocery operations.

Whole Foods said it strikes a balance when it comes to consumer messaging. The Amazon-owned grocer tends to “not go too deep into the science” in its store messaging and instead keeps in-depth information on its website for consumers who want to seek that out, Sonya Gafsi Oblisk, the grocer’s chief merchandising and marketing officer, said during a Sunday session.

Whole Foods promotes its product standards to appeal to not only wellness-focused consumers but also culinary-oriented ones. A recent bag redesign, for example, lists the hundreds of ingredients banned from the grocer’s shelves to highlight the consistency of the chain’s values.

“Customers are definitely gravitating [toward] a clean ingredient label,” she said.

Social commerce is the new frontier

Grocers have been focused on omnichannel retailing in recent years, and while that will continue to remain a priority, social commerce and quick commerce are rapidly gaining traction, Jennie Bell, managing director of snacks and beverages at NielsenIQ, said during a Sunday session.

“If you are a brand or retailer, it’s critical that you hop on board social commerce, and quick commerce will be the future … You have to be willing to explore in this digital age of social commerce,” Bell said.

Social commerce — which includes shopping on platforms like Facebook, Instagram and TikTok — is expected to become more personalized to customers, Bell said. TikTok Shop handles nearly $6 billion in sales, with food as the No. 2 seller in CPG sales on the platform, she said. Snacks, in particular, are hot sellers on TikTok Shop, Bell noted. Other foodie trends that have taken off on social commerce include freeze-dried food, cottage cheese and whipped coffee, she said.

Tech mainstays dominated

Vendors on Groceryshop’s exhibit floor primarily promoted upgrades to existing technology instead of flashy, new solutions.

Many of the robots moving around Groceryshop’s exhibit floor were geared toward inventory management. They included a new bot from Brain Corp and ShelfOptix that offers a portable scanning-as-a-service solution to check on-shelf pricing and inventory. Simbe’s Tally — which has digital blinking “eyes” — and an advertising bot from Scandit were also roaming around.

Grocery Dive also spotted a fair amount of in-store retail media solutions, primarily in-store screens from third-party companies like Grocery TV. Smart carts, on the other hand, were few and far between.

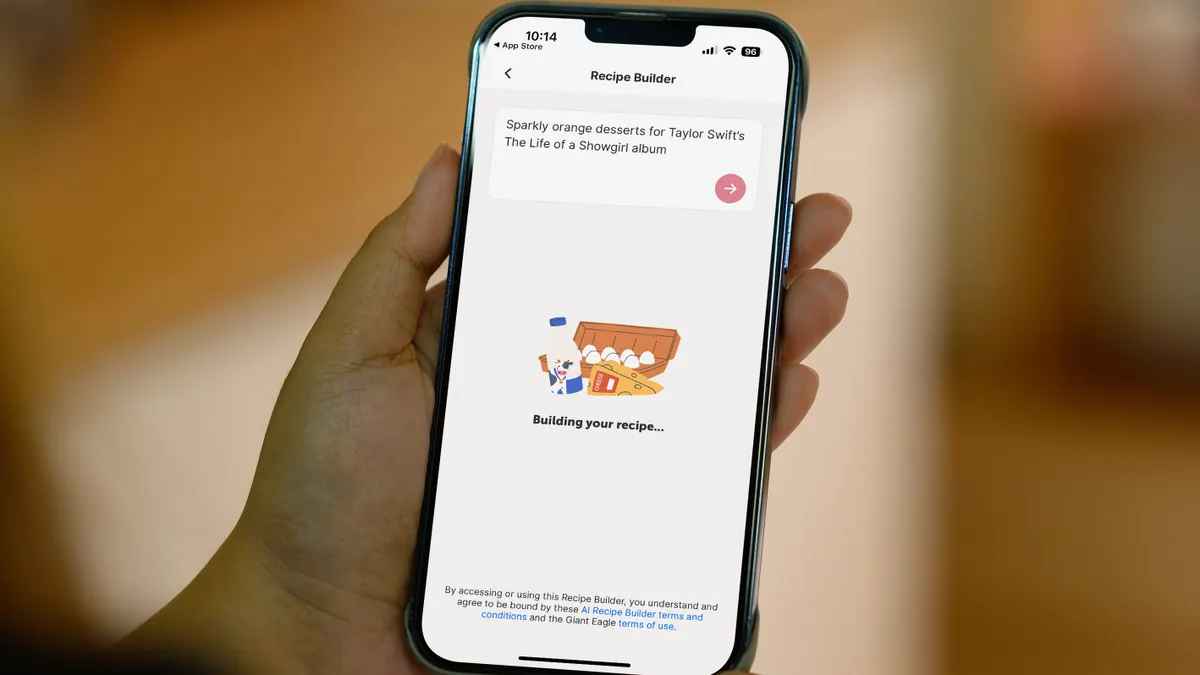

From sessions to one-on-one meetings, retailers expressed a desire to seek out loyalty program solutions. During the show, Eagle Eye and Giant Eagle announced the launch of a real-time loyalty and incentive solution called Smart Rewards, which allows shoppers to automatically receive discounts.