Dive Brief:

- Walmart’s U.S. comparable-store sales excluding fuel rose 4.6% during its fourth quarter of fiscal year 2026, as digital sales led transaction growth, the retailer reported Thursday.

- Walmart U.S.’s grocery category recorded mid-single-digit comps growth in Q4, led by fresh and pantry items. The company’s grocery inflation was about 70 basis points lower than in the prior quarter, mainly due to the deflation in eggs and dairy.

- Grocery e-commerce sales in the U.S. grew by double digits in Q4 as customers turned to Walmart for the convenience of getting their groceries delivered, the company noted in an earnings presentation.

Dive Insight:

Walmart’s online grocery growth in the U.S. comes as the company continues to ramp up its e-commerce operations by focusing on supply chain automation.

Walmart recorded 27% growth in e-commerce sales in the U.S. in Q4. About half of its stateside e-commerce fulfillment center volume is automated, and 23 out of 42 regional distribution centers are in “various stages” of being retrofitted for automation, according to the company.

Walmart’s massive store fleet is playing a starring role in the company’s e-commerce efforts. Delivery in under three hours accounted for about 35% of store-fulfilled orders, Walmart said.

“We’re increasingly leveraging stores as digital fulfillment nodes to move inventory faster and more efficiently than ever before,” CFO John David Rainey told investors during the company’s earnings call on Thursday.

Along with e-commerce and supply chain operations, Walmart executives highlighted that the company is tapping AI in other areas of the business.

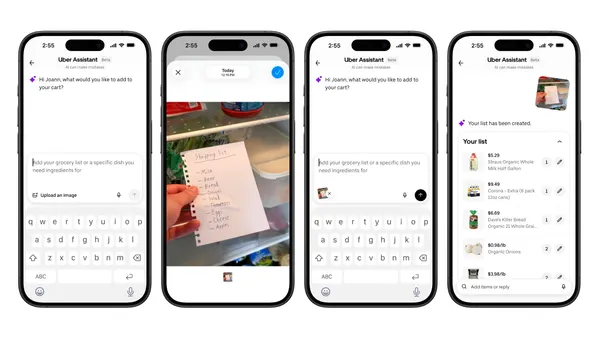

Customers who use Sparky, Walmart’s AI shopping assistant, have an average order value that’s about 35% higher than people who don’t use the tool, Walmart President and CEO John Furner said during the call. While Sparky originated in the U.S., Furner noted that Walmart is looking to offer consistent shopping experiences across markets.

“We need to focus on technology platforms that are built for a global business,” Furner said. “The idea of ‘build one, scale globally’ makes us faster, lowers costs and ensures consistency, and we’ll use AI to layer on top of existing platforms, getting better leverage out of the assets we already own.”

He added: “The future is fast, convenient and personalized, and I’m challenging our teams to move even faster as the opportunities with AI become broader and deeper.”

During Q4, Walmart opened four new supercenters and remodeled about 125 stores in the U.S. In fiscal 2026, Walmart opened 12 new stores and finished roughly 675 remodels.

In Q4, Walmart U.S. had about 6,200 price rollbacks, up about 23% from a year ago, Furner said.

For fiscal year 2027, Walmart expects its overall net sales to increase by 3.5% to 4.5% and adjusted operating income to rise by 6% to 8%. Rainey said Walmart aims to outperform this guidance.

“We expect e-commerce will continue to be the primary driver of growth, with modest increases from store and club sales,” Rainey said.