In the quest to snap up consumers’ meal dollars from restaurants, Walmart is giving grocers a run for their money.

While grocers have long considered foodservice to be a competitive moat against Walmart, that may not be the case for much longer, especially as Walmart offers up a selection of fresh food in different preparation states and more flavors.

Long known for its low prices and no-frills store experience, the mass retailer is growing its eclectic roster of QSR partners for in-store restaurants, including hot dog and poke providers, and adding grab-and-go sections with prepackaged salads and sandwiches and even hot bars — one of which sports Indian cuisine.

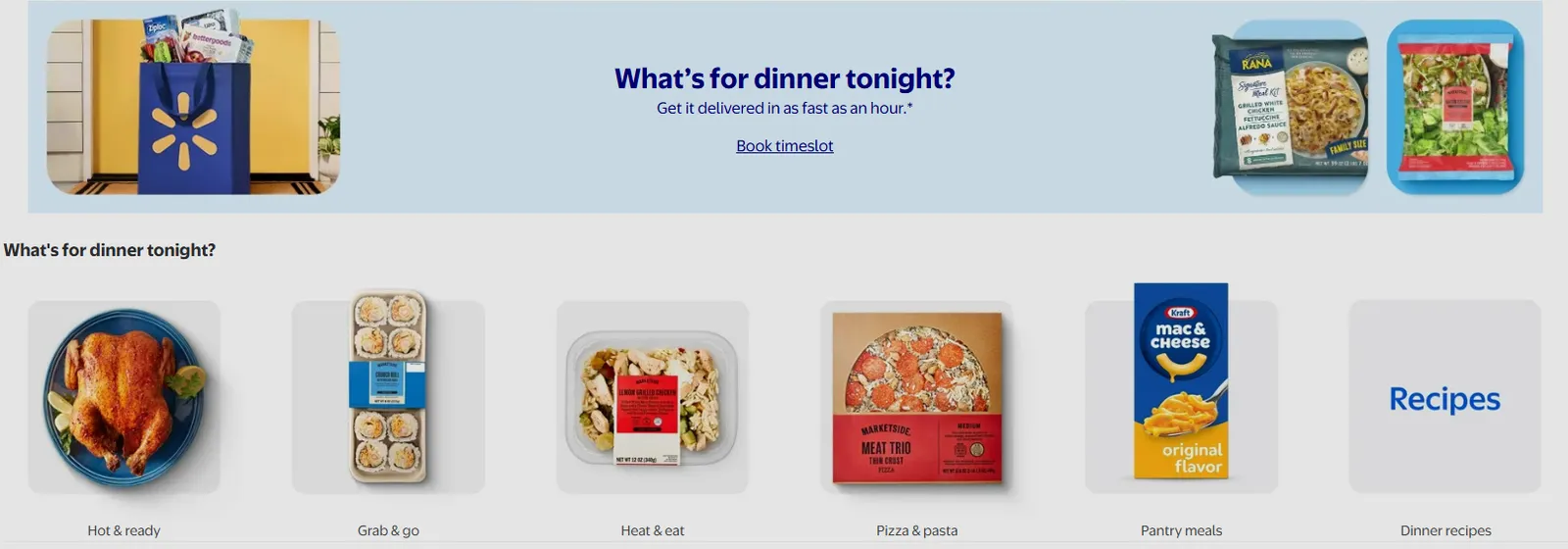

Online, Walmart is spotlighting a bevy of meal options like hot food, grab-and-go, heat-and-eat and ready-to-bake pizza on its app and website, Walmart U.S. President and CEO John Furner noted in a recent LinkedIn post.

On Walmart’s grab-and-go page, meanwhile, shoppers can find ready-to-heat soup, salad kits and chicken wraps. Items under the retailer’s Marketside brand include a sunflower bacon crunch chopped salad kit, a spinach dijon salad bowl and an Italian hero sub.

Foodservice furthers Walmart’s goal of becoming a one-stop shop and comes at a time when economic uncertainty is pushing more consumers to shop at discounters and mass retailers.

Walmart’s combo of price and convenience is “a knockout punch” that it can wield against regional grocers trying to compete with the retailer, said Anne Mezzenga, co-CEO of Omni Talk. This can urge grocers to up their game to maintain an edge, sources said.

“One of the big advantages that regional grocers have over people like Walmart and Target and Costco is the fresh prepared foods. … They can really focus on having higher quality, because they don't always have to play on price,” said John Clear, partner at consulting firm AlixPartners.

How Walmart is cooking up its meal options

The timing of Walmart’s foodservice efforts couldn’t be better for the retailer. As consumers grapple with an uncertain economy, those fretting about how much they are spending on meals may shift to Walmart. And while some may return to traditional grocers when their wallets are less squeezed, Walmart will likely convince many others to stick around, said Michael Orehowsky, director at West Monroe Partners and a former Giant Eagle executive. Orehowsky left the grocer in 2016 after more than 12 years in leadership positions with the chain’s convenience store, supply chain and operations divisions.

Walmart’s expansion of foodservice also comes as the retailer is looking for ways to bring in and keep higher-income customers, who tend to spend more than other shoppers, Clear said.

Walmart’s work to cook up more foodservice options is happening alongside the retailer’s efforts to elevate its in-store and omnichannel experiences. The company is currently rolling out its Store of the Future concept to more than 150 locations.

The first new-construction location under that concept opened in Cypress, Texas, in April, and features a variety of service options like auto care, a vision center, a wider assortment in key categories and QR codes throughout the store to help shoppers access digital tools. The store offers an array of fresh prepared food items in areas like a Hispanic bakery section and a sushi station. It also features a fresh tortilla maker and a Dunkin’ outpost.

Walmart Canada’s flagship store, which was recently renovated to follow the Store of the Future concept, offers a hot bar surrounded by other food options. At the hot bar, customers can find a variety of regionally inspired dishes such as eight pieces of chicken wings, two pieces of jerk chicken legs, curry chicken and Jamaican oxtail, according to an Omni Talk video. Mezzenga, who toured the store earlier this year, said the hot bar offerings were reflective of customer demographics in the area.

The main level of the two-story location also offers heat-and-eat options, a made-to-order sushi bar, bakery, and prepackaged ready-to-eat choices, giving customers a range of meal options, Mezzenga said.

“If this is a place where I'm popping in regularly for hot food, there are so many options and opportunities to get everything else that you could want or need in that one trip,” she said. It’s a “very elevated experience” that puts it on par with Wegmans, the East Coast grocery chain known for its broad array of prepared food options, Mezzenga said.

While Walmart is displaying a wide array of new and improved foodservice options, it’s unclear how, when and where the company will roll these offerings out — although local news reports of store openings and remodels indicate that Walmart will continue rolling out more meal options as it updates and debuts locations, including the Cypress, Texas, store and a remodeled Neighborhood Market on Long Island.

Consumer trust is a key hurdle for Walmart’s foodservice push, Clear said. The retailer traditionally lags consumer trust scores in fresh and quality compared with strong regional players like Publix, Wegmans or Sprouts Farmers Market, which means Walmart will have to win over skeptical shoppers in order to grow this business.

“I think trying to convince customers that the quality of [a Walmart meal] is better than what you're used to at other places is going to be a challenge for them,” Clear said. “What they'll probably need to do is a combination of convenience and price” to incentivize customers.

Still, Walmart has made “a lot of strides” over the last decade with consumers’ perception of quality, said Orehowsky.

How grocers can craft a recipe for success

While Walmart has size, scale and a fail-fast mentality, “high-performing” regionals have a clear advantage when it comes to freshly made meal options, Clear said.

Regionals better know the communities where they operate and can roll out creative options to meet their shoppers’ needs, Clear said, giving the examples of regional and seasonal “menus.”

“[Regionals] pretty much are always going to be able to have a broader, more nimble and more tailored fresh assortment in these freshly made salads and sandwiches than Walmart because they've got more equity to experiment with tastes, to experiment with premium-style products, to experiment with different approaches and seasonal offerings,” he said.

While it’s hard for traditional supermarkets to justify higher prices on commodity items, they can hold the line on higher prices for discretionary items that compete on quality, taste and assortment, Clear said. Popularity and virality — think Pub Subs and Sprouts’ deli sandwiches — can also play key roles in driving loyalty to regionals, he said.

Regionals like Wegmans and Publix have been relatively strong in providing options for different dayparts and different family sizes, Clear said, noting that he expects that differentiation to continue.

Traditional supermarkets can hook consumers with a foodservice item they are known for, like fried chicken, Orehowsky said, noting that sampling can be a prime way to introduce customers to items. Scratch-baking certain baked goods or offering in-house butchers can also attract customers and help differentiate from Walmart, he said.

While some grocers like Whole Foods Market, Publix and Wegmans have made fresh prepared food a key part of their reputations, other traditional grocers don’t have a solid grasp on how to serve up differentiated foodservice offerings.

“I still go into a lot of regional grocers, and yes, they have a hot bar, but it's a lot of the same things that we've seen in hot bars for years,” Mezzenga said. “You're not seeing them really look at who their demographic is and catering to those specific dishes,” such as vegetarian options if the store has a large Indian shopper cohort.

Traditional grocers can also provide a range of meal options with prices corresponding to how ready the food is to eat. Ready-to-eat meals can command higher prices, for example, than take-and-bake items.

“I think the best thing that the regional players could do is just really try to lock in their strategy when it comes to what their heat-and-eat or takeaway food offerings are, and adapt that so that they are truly serving each environment that they're in and the customers that shop that store,” Mezzenga said.

Even with the shift to online and omnichannel, customers still care about the in-store experience, and store workers can play a key role in helping shoppers find quality items, Orehowsky said. Walmart stores still have a “warehouse” feel, giving traditional grocers an advantage in providing an ideal in-store experience, he said.

Grocers such as Publix, SpartanNash and Schnuck Markets have embarked on remodeling initiatives that include foodservice enhancements, while others have leaned into opening innovative food-focused formats, like Northgate González Market’s immersive Mercado González and Save A Lot’s Hispanic grocery store concept Ahorra Mucho.

Grocers shouldn’t underestimate the importance of their staff, Orehowsky said. With training on product quality and freshness, workers can educate consumers and inspire their purchasing decisions by helping them find relevant items, Orehowsky said. Store workers should also have time and opportunities to interact with consumers to help create a memorable shopping experience, he added.

Grocers should also stress to workers that they are “building that culture within the store that we're that community store. We're feeding the families that you know around us,” Orehowsky said.