The top trade organizations representing supermarkets are urgently calling attention to the importance of SNAP as a proposal that would slash the government assistance program’s funding moves forward in Congress as part of a tax-cut megabill.

Last week, the House Agriculture Committee advanced legislation that would cut as much as $300 billion in nutrition spending as well as overhaul SNAP by requiring states to help fund the program’s benefits, Politico reported. On Sunday, the House Budget Committee passed the tax cut bill, clearing the way for a House floor vote, which could happen this week, Reuters reported.

SNAP cuts on the federal level would help fund the party’s domestic policy plan and some farm bill programs, Politico noted. The chairman of the House Agriculture Committee has said that too many “work-ready” people are on SNAP, arguing for stricter work requirements for participants in the food assistance program.

The proposed cuts come at a time when consumers continue to worry about their grocery spending and how trade policies could potentially increase the cost of goods, including food. Walmart is bringing back its $6.99 minimum basket fee for SNAP consumers who place online orders under $35, Reuters reported at the end of April.

As of February, more than 42 million people participate in SNAP, up 2% from the same time last year, according to the USDA. SNAP accounts for around 5% of all supermarket purchases, the FMI — The Food Industry Association shared during a webinar last week, and retailers have shared with investors how reductions in SNAP funding can hurt their sales.

SNAP is “very well received across the political spectrum,” Jennifer Hatcher, FMI’s chief public policy officer and senior vice president of government and member relations, said during the webinar. Fifty-nine percent of people are opposed to cutting or reducing SNAP funding, while one-third are in favor, Hatcher said, citing a survey of 1,000 people Fabrizio, Lee & Associates and FMI conducted in late April.

The proposed SNAP cuts have struck a dissonant chord with the grocery industry, with the National Grocers Association saying it is “deeply concerned by the cuts and programmatic cost shift changes” in the proposed legislation.

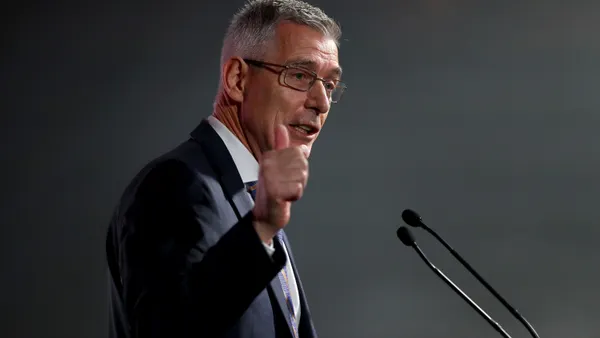

“SNAP is not only essential to fighting food insecurity, but [is] also a proven economic engine for thousands of local communities across the country,” NGA President and CEO Greg Ferrara said in a statement on Tuesday.

SNAP funding not only addresses food insecurity but also supports the economies of local communities, such as by generating over $4.5 billion in state and federal tax revenue annually, Ferrara noted. The trade association had previously cited data that every $1 invested in SNAP generates $1.79 of economic activity in communities.

“[The] committee’s proposal to shift costs to states is a concern given the challenging headwinds that states face,” Ferrara said.

Earlier in May, the NGA said it met with representatives of four Democratic members of Congress to urge Congress to limit SNAP funding cuts.

“We urge Congress to pursue balanced reforms and solutions that strengthen the program, eliminate waste and fraud, and uphold the health and economic well-being of American families, while preserving American jobs in our food chain and grocery industry,” Ferrara said last week.

FMI is advocating for the continuation of federal governance of SNAP to ensure continuity.

“We believe complex, differing SNAP restrictions sorted by states would cause delays, errors and disputes, further slowing the checkout speeds, frustrating customers and increasing operational costs,” Hatcher said.

By a 57%-to-39% margin, survey respondents want a single national standard on what SNAP can be used for, according to FMI.

To help ensure stakeholders have up-to-date information as discussion of SNAP policy changes continues, FMI recently launched a new website to provide the survey data and serve as a resource for information about the current discussions around SNAP.

Along with the federal proposal, approximately 25 states this year have considered restricting SNAP participants from buying specific items like candy and soda, and those state policy changes would require getting a waiver from the USDA, Hatcher said, noting that Arkansas, Indiana, Nebraska and Iowa have already submitted waiver requests.

FMI has pushed back on efforts to limit how SNAP participants use their benefits, noting that “the best results” are those that make resources available like dietitian-supported recipes or curated shopping experiences, Hatcher said. FMI has said that different state policies could confuse shoppers and retailers.

“The future strength of this program isn’t just a policy issue—it’s a moral imperative and an economic necessity,” Leslie G. Sarasin, FMI president and CEO, said in a statement.

Peyton Bigora contributed reporting.