Alex Robinson has seen grocery apps evolve dramatically over the past decade or so. As one of the founding members of Kroger’s mobile development team, he helped introduce product scanning and list-making tools. This was back in the early days of smartphones, when retailers primarily viewed apps as tools to enhance in-store shopping, Robinson said. Now, retail apps have become ordering devices, checkout scanners, gateways to augmented reality and much more.

Robinson, who left Kroger in 2013 to head up Atomic Robot, the app development studio he co-founded, has worked with companies like Walmart, Procter & Gamble and Subway to roll out some of these new features. He’s also continued to work with his former employer on developing new apps, like ones for Kroger's Ruler Foods banner and for the company's OptUp health and nutrition app, as well as honing services like click-and-collect and digital loyalty.

App usage was climbing rapidly before the coronavirus pandemic, and now it’s soaring, Robinson said, as consumers not only use programs to grocery shop, but also to order takeout, track their health and altogether manage their lives.

Robinson, along with Atomic Robot UX/UI designer Leah Blandford, recently sat down to talk about the key role grocery apps have played over the past year, what features retailers are investing in and how programs might evolve in the coming years.

This interview has been edited for length and clarity.

GROCERY DIVE: Nearly a year into this pandemic, how are you seeing people use their grocery apps?

ALEX ROBINSON: I see a big focus on contactless curbside pickup. I don't see that going away after the pandemic. Contactless payments are another big thing — for consumers, not having to pull your credit card out or worry about cash and for retailers, saving on credit card transaction fees. I think contactless payments are going to continue to be an important aspect of the checkout process.

LEAH BLANDFORD: I think grocery apps are still used for planning, but instead of planning for their trip to the store, consumers are planning for pickup orders. I think their mindsets have shifted just slightly. I also think an interesting piece of contactless payments is just how customer service works. How do you inject that little bit of personality or personal touch into a contactless system? I think that's a problem in the design space that grocers are beginning to try and solve.

How might customer service touch contactless payments?

BLANDFORD: I'm just thinking of things like addressing people by name, follow-up surveys to ask about their experience, making sure that they're checking in on the customer themselves and not just focusing on product moving back and forth.

ROBINSON: I think that's one of the biggest challenges with Starbucks and similar solutions, is that they're so busy trying to rapidly fulfill orders that personalization isn't there anymore. I'm used to making eye contact and saying "Thank you" and getting to know the barista. I like the experience of walking into a Starbucks and they immediately recognize me and start my order. That doesn't happen anymore.

I feel like if we go back a couple of years, there was an emphasis on adding a lot of different bells and whistles — map features, various list-making and scanning functions — to grocery apps. Is that still the case?

ROBINSON: That's a problem we struggled with for years, and I don't think we ever quite figured out. Do you break that into multiple apps? Is pharmacy a separate app or is it part of the same app? I think identifying different user groups is important. There’s a big difference between the soccer mom that goes to the grocery store every week and essentially buys the same thing for her family and knows the store backwards and forwards, versus the person that stops in and has no idea where anything is. That’s the audience that always says, “I want the store map.”

The frequent users don't need the same type of functions as the infrequent users. And I always thought it was kind of weird that we would cater to the less loyal customers. While the infrequent shoppers are important, we should try and make the experience as easy as possible for the folks that shop every week.

There seems to be more focus on consolidating apps. Walmart did it recently, but some grocers have three or four apps covering different services like pharmacy, deli and so on.

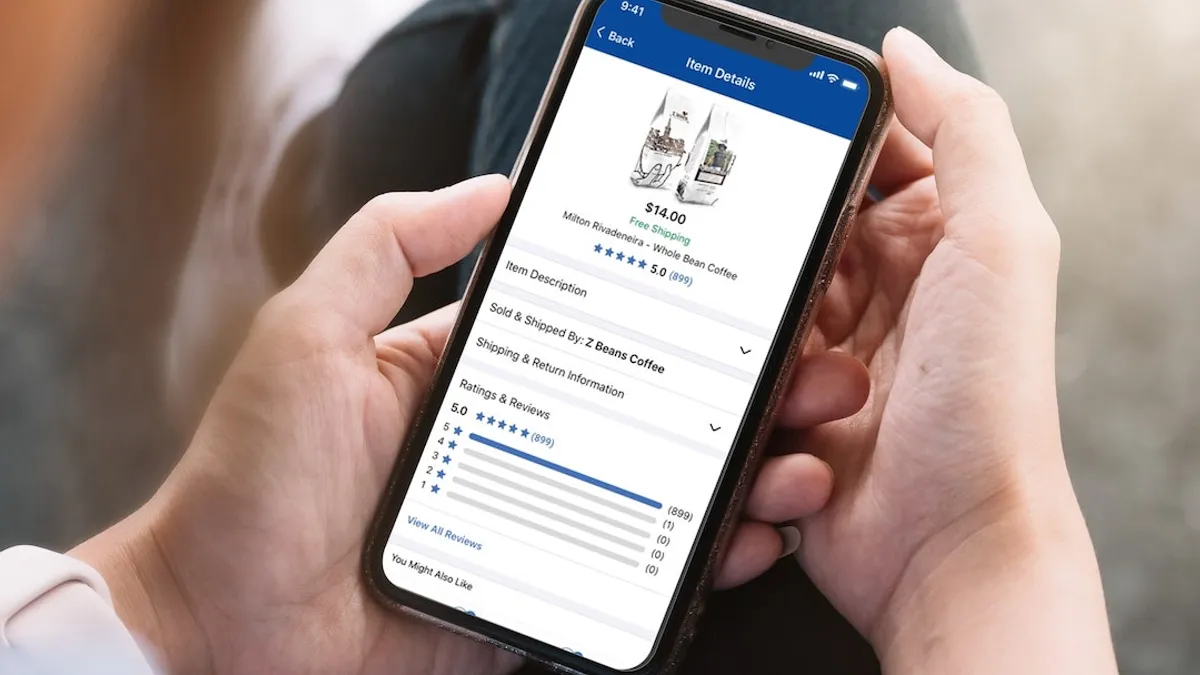

BLANDFORD: I think you can cover those different services in one place by doing effective onboarding and letting customers choose their own adventure. If pharmacy is important to them, let them pick pharmacy as a tab on the bottom, or if a shopping list is important to them, put the shopping list as their home screen. With the Ruler Foods app, a lot of those consumers are on more of a fixed budget. Not only was having the shopping list important, but also providing a guesstimated total so that they could plan ahead.

Walmart recently came out with these new app-enabled stores where the intention is that you shop with the app in hand and you're using it to navigate to add products. Is that the future of the grocery store?

ROBINSON: I think there's definitely an audience for that kind of self-driven experience where you don't have to interact with anybody. I always like going to the Apple store, and for the small items you just open the app, scan them and then walk out. I don't know about you but there's been multiple times where I just want one or two items at the grocery store. And then I get to the checkout and see the line and I'll just give up and walk out.

You’re talking mainly about mobile checkout. What’s your take on those scan-and-go programs? Interest seemed to be lukewarm pre-pandemic and then it’s really gotten a charge over the past year or so. Are those viable over the long term?

ROBINSON: There’s definitely an appetite for more of a self-service experience, but what about the mom that's juggling a kid, a purse and a whole bunch of other things while trying to do their shopping? You don't necessarily need more distractions and looking at your phone while also trying to keep an eye on your 3-year-old is very difficult. I don't think anybody's really nailed that experience yet for that particular audience. I think there are still ways to improve on that.

BLANDFORD: It changes the psychology of shopping in a way because if you're doing Scan, Bag, Go (Kroger’s mobile checkout program), you're seeing that running total add up. And I think consumers may be more likely to put products back or not purchase extras if they're consciously aware of that total. I think it puts more awareness on the spend instead of just the gratification of grabbing the product.

What do retailers seem to be looking for in their grocery apps right now?

ROBINSON: It's figuring out what that hook is that drives engagement. Quite honestly, a basic shopping list tool — there’s so much competition there, and your biggest competitor is pencil and paper. So that's not really going to keep the user coming back. But figuring out how to integrate loyalty programs and help the consumer save money is so important. The first feature we released with the Kroger app was digital coupons, and that ended up being the perfect feature because people really care about saving money. It gave them a reason to come back to the app every week.

There’s also the consumer intelligence aspect. Retailers are trying to figure out ways to monetize their mobile applications as well, whether it's selling advertising space inside the app or coming up with different ways of monetizing the data that they're collecting.

Do retailers increasingly see apps as data gathering tools?

ROBINSON: It’s a big topic of discussion. Retailers are spending time and money figuring out how to collect more data and get more intelligence about the customer, both in-store and out of the store. At the same time in the tech industry, privacy continues to be of heightened interest for consumer protection. I don't think consumers have any idea how much information every major retailer has about them. And Apple keeps cutting off some of those avenues, so tracking consumers in the store is getting more and more difficult. I know the big retailers are desperate to figure out how to do that in a way that isn't going to get blocked by the technology or various privacy acts that state and regional governments are putting in place.

How do you see apps evolving, with adoption so high and so many people using them to order groceries?

ROBINSON: We’re definitely seeing continued investment in machine learning AI to better predict what consumers want to buy. I see that becoming more accessible to mid- to large-scale retailers. And that plays into simplifying the experience for the consumer. Data science is right now one of the highest-paying tech jobs out there. And a lot of the CPGs and retailers seem to be hiring in that area or acquiring companies that do nothing but that.

BLANDFORD: As the competition grows in this digital space, there has to be some sort of differentiator. I do feel like the differentiator is personalization and being personable and making sure you're really relating to your specific audience. You can't just blast out to the masses anymore because there's too much competition to do that with. You have to be really pointed with your experience.

What's an example of what personalization looks like in a grocery app these days?

ROBINSON: If you have Type 2 diabetes or specific dietary needs, it’s customizing that experience so you're seeing only relevant items. It can be hard to shop in a grocery store if you need to eat gluten-free or if you have certain allergies. It’s especially difficult considering the growth of click-and-collect, because the whole substitution process is very error-prone. You might have a serious allergy, and the associate may not have been trained properly or they might not have a good process in place and they might substitute something that you're allergic to.

What do you see as the biggest barriers to retailer adoption of grocery apps?

ROBINSON: For the retailers that have been slow to invest in that space, it's often been because they don't know where to start. There are so many different things they could do to be competitive with companies that have already invested millions or even billions of dollars in their digital program. The other aspect is that a lot of their back-end systems weren't really designed for consumers, so figuring out how to take a legacy loyalty system and make it something that makes sense for a consumer usually takes rethinking the process a bit.