The National Retail Federation’s 2026 Big Show was a whirlwind of technology innovation, from artificial intelligence insights to robots roaming the expo floor. It even included a visit from actor-entrepreneur Ryan Reynolds.

Grocery Dive attended the three-day conference held in New York City earlier this week and spoke with retailers, industry experts and technology vendors about what is top-of-mind for grocers in 2026 — especially when it pertains to AI, which was the star topic of the conference.

Here are four takeaways from this year’s NRF show.

1. AI rules the retail world — but how do grocers fit it into theirs?

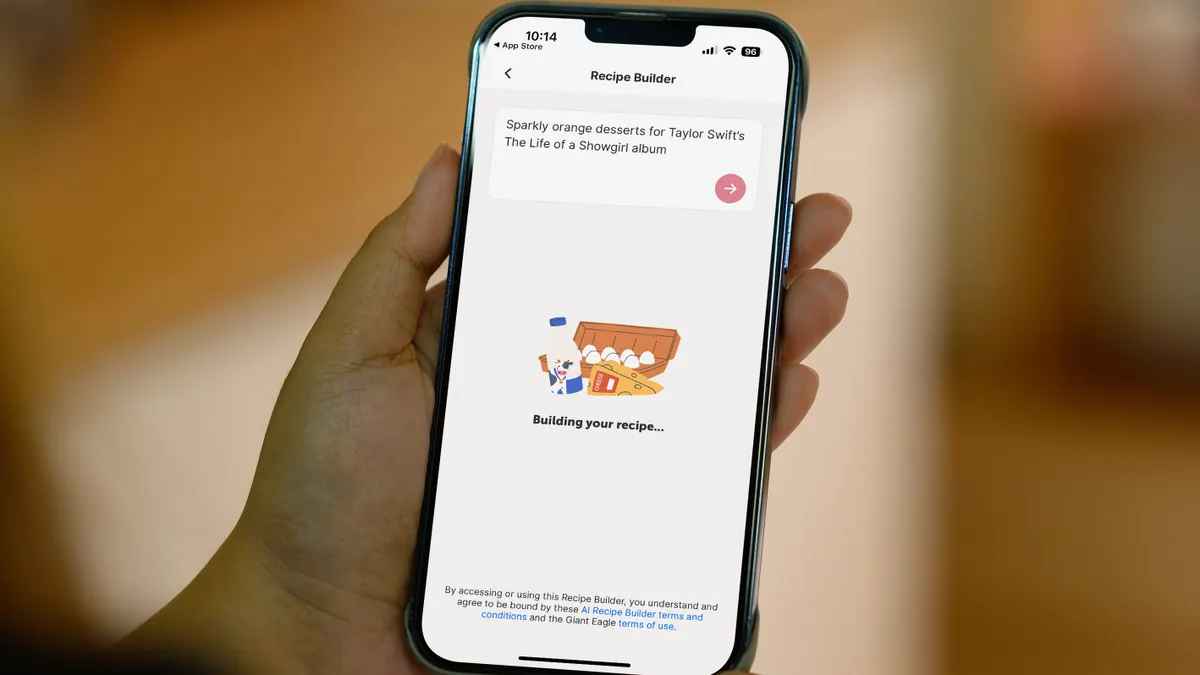

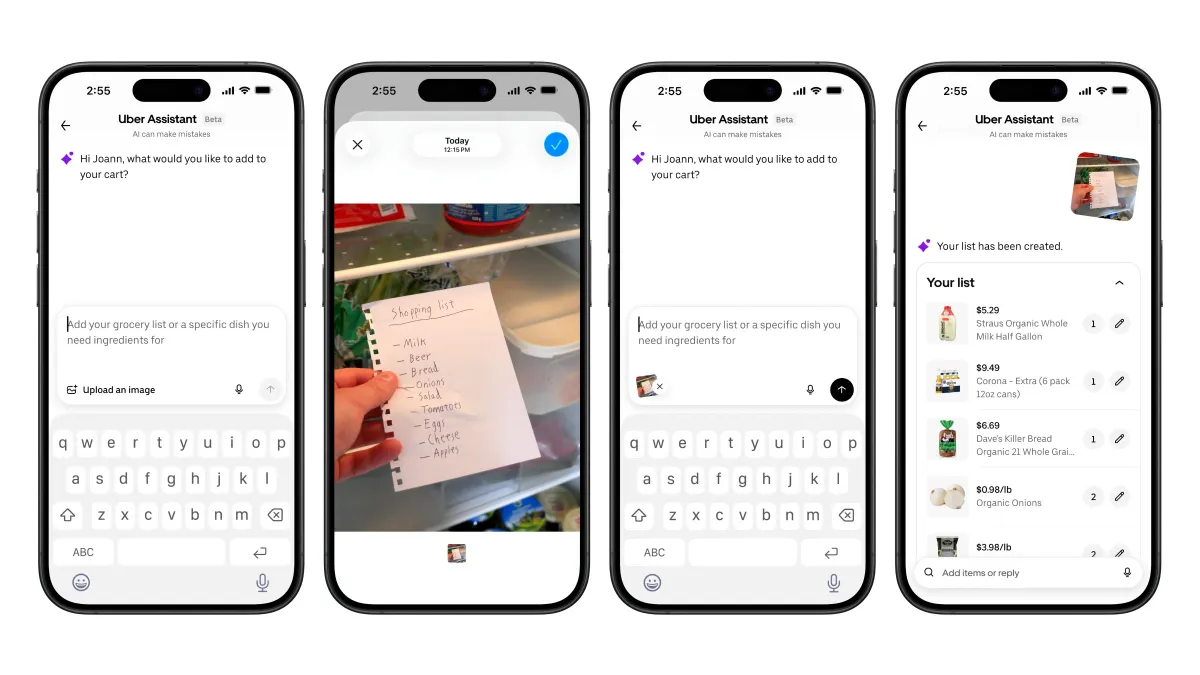

There was no escaping AI at this year’s NRF shows. As retailers implement AI into their operations, sources said that grocers need to focus on how consumers are increasingly turning to the tech to find recipes, generate shopping lists and compare prices.

While AI isn’t new — supply chains have been using it for years, primarily for forecasting — the increasing consumer adoption of AI has shifted the technology’s use-case from back-end to front-end operations, Kelly Pedersen, a partner and global retail leader at PwC, said in an interview.

“[AI is] so dynamic with the consumer and they’re actually using the technology to discover new products, find new products, buy new products directly in the platforms, [and] get recommendations,” Pedersen said.

Despite this quick evolution of AI, grocers have more time than other retailers to adopt the capabilities, Pedersen said. But grocers also face challenges that other retailers don’t.

Grocery shopping is a very localized habit, he said. While other retailers, like apparel, are shipping from one or two major warehouses, grocery e-commerce is often still tied to the nearby brick-and-mortar location, which adds more complexities, especially around demand. Grocers also turn their inventory much faster, making product availability tougher.

These are challenges that presented themself when e-commerce became exceedingly popular during the height of the COVID-19 pandemic, but now with AI, consumers want to know if a grocer has a product in demand and what the price is.

2. Grocers link up with Google

Google CEO Sundar Pichai took to the keynote stage on the first day of the conference to give a multitude of AI updates and announcements — some of which involve grocers.

Google most notably is building out its Gemini tech model with the launch of Gemini Enterprise for Customer Experience, an agentic AI solution designed to bring shopping and customer service operations under a single interface. This tech suite also includes the Customer Experience Agent Studio, which aims to help businesses build, test and deploy AI agents that can take autonomous action, sister publication CX Dive reported.

“It transforms fragmented search, commerce and service touch points into a seamless customer journey, whether you need a shopping assistant, support, bot, agentic search or help with merchandising,” Pichai said during the keynote, adding that the technology will “answer detailed questions across the entire shopping journey.”

Google is essentially creating a one-stop-spot to shop online, allowing consumers to look up an item or recipe they desire on Google and see all their retail options as well as pricing, reviews and more.

Kroger is one of the early adopters of Gemini Enterprise for CX and Customer Experience Agent Studio. Walmart also announced plans for a new consumer experience directly in Google’s Gemini chatbot on Sunday, sister publication Retail Dive reported. The capability will allow Gemini users to discover Walmart and Sam’s Club products when conducting a search, and the chatbot will automatically include relevant in-store and online items.

3. Store-level focus with tech innovation

While consumer-facing AI and digital capabilities are flashier and usually garner more attention, grocers are more focused on giving those solutions to their frontline employees.

Consumers still crave an in-store experience when grocery shopping, so ensuring store-level associates can locate products, know which items are in stock, answer questions and not be bogged down by inventory tasks are crucial to ensuring a positive in-store experience.

Sprouts Farmers Market, for example, discussed during a panel session at NRF how it has gamified its employee training with “bite-sized” content. This approach provides information through daily reinforcement and engagement that’s more enjoyable than traditional training methods while also giving staffers more time with customers and on the store floor. Store managers also have the opportunity to see which store training areas need more attention.

Kroger executives talked about Sage, its AI virtual assistant that provides its workers with a single point of access to check their shift schedule, request time off, set shift availalbility and view their pay stubs. With Sage, Kroger’s store leaders can get real-time labor data insights as well as view shift changes at each store.

4. Showcasing value doesn’t mean a race to the bottom with pricing

Communicating value was the second biggesttopic among grocers and food retail industry experts at NRF. Of all the grocery formats, traditional grocers need the most tactful value proposition strategy as they battle specialty grocers and discounters for consumer dollars.

For traditional grocers to underscore value and their price competitiveness, it takes some “basic blocking and tackling,” Matthew Pavich, senior director of strategy and innovation at tech software company Revionics, said in an interview.

Pavich said grocers first need to focus on their everyday pricing strategy. While traditional grocers can’t compete on price across their assortment, they can “surgically identify” the items they absolutely need to apply competitive pricing, Pavich said.

Promotional strategy comes next, an area “where there’s a lot of room for improvement for retailers,” according to Pavich. Rather than grocers routinely cycling through promotions, they should evaluate if the initiative improved or hurt profits, drove excessive labor for minimal lifts, or cannibalized private label sales.

“Retailers have a lot of power with pricing to offer lower prices, grow their private label and, when you have all the analytics to do that, that can really be a powerful tool — especially right now because… how can you compete with Walmart and Aldi on everything?” Pavich said.