Pardon the Disruption is a column that looks at the forces shaping food retail.

By all accounts, Kroger’s new CEO is an operations guru and a true grocery merchant who is well-suited to refocus a supermarket chain that’s gotten sidetracked.

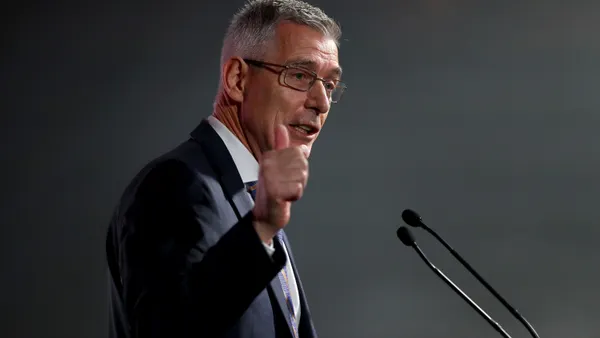

In the days since Greg Foran’s hiring, news outlets and industry experts have pointed to his impressive achievements at large, complex companies. He whipped Walmart’s U.S. grocery business into shape over the course of several years and piloted Air New Zealand through the incredibly difficult period defined by the COVID-19 pandemic.

What I find most compelling are the stories that illustrate Foran’s hands-on management style. According to the book “Winner Sells All” by Jason Del Ray, while president of Walmart U.S., Foran flew to Canada to taste-test new store-brand croissants after deeming the current ones inferior. The book also notes that Foran prized simplified assortments, and while visiting Walmart stores would often lay out on the floor all the offerings from a brand that he felt occupied too much shelf space.

Once, a representative from a candle supplier spotted Foran quietly touring a store early on a Sunday morning. After the supplier introduced himself, Foran proceeded to ask him multiple questions about his experience as a Walmart supplier as they walked the candle section, the former representative noted in a LinkedIn comment.

Foran, by his own account, sweats the small stuff but doesn’t get bogged down in it.

“I like to get into the details and understand them,” he told the Harvard Business Review in 2017. “Only when you have understood them and dealt with the complexity of them do you have the right to simplify.”

This is an ideal type of leader in the grocery industry, where companies succeed not only by moving large quantities of goods but also by ensuring their steaks are at peak freshness and their apples and berries are free of blemishes. And it’s a particularly good fit right now for Kroger, which stakes its brand on being “Fresh for Everyone” but has taken its eye off the food retailing ball as it’s chased alternative revenue streams, in-house grocery delivery capabilities and a mega-merger that failed.

Figuring out Kroger’s identity

All told, Foran looks like the right pick to make Kroger a better supermarket operator over the next few years.

But long-term, Kroger needs to become more than just a better version of itself. It may be able to streamline operations and bring prices down, but it likely won’t be able to beat the likes of Aldi, Walmart and Amazon on those fronts. And while it’s certainly capable of making marginal improvements to the store experience, it would be hard to match the premium shopping that gourmet and specialty grocers offer.

The fact remains that the traditional supermarket model is losing relevance with consumers. The one-stop shopping approach has become less appealing to people, and research shows that shoppers are gravitating more toward discount and specialty grocers than middle-of-the-road conventional grocery chains.

This begs the question: Can Kroger’s new CEO ultimately forge a new identity for the chain?

Or, put another way: Can Foran position Kroger stores for the future and become known for something besides just carrying a large selection of goods?

There are several examples of supermarket chains that have crafted compelling identities. Publix, which operates over 1,400 stores, is known for top-notch service. H-E-B has local flair at the heart of its reputation, Wegmans is renowned for foodservice excellence and Woodman’s Markets, which was recently ranked third in Dunnhumby’s retailer preference index, is renowned for its low prices and large, well-organized stores.

Kroger may already be taking steps in the right direction by focusing on its Marketplace format. It’s building more of these cavernous stores, particularly in competitive markets like Dallas-Fort Worth and parts of Kentucky. I’m curious to see how Foran and company will approach a store model that can house so many different products and services. Will this become Kroger’s supermarket of the future or just a traditional store on steroids?

Keeping pace in digital

Kroger made clear even before Foran’s appointment that improving its stores is its first order of business. But the company can’t neglect e-commerce as that channel continues to grow. Right now, it’s pulling back on its proprietary delivery service and focusing more on store-based fulfillment via delivery apps, which makes economic sense but also lumps it in with just about every other grocer in the country.

Amazon is giving its members more ways to get same-day fresh grocery delivery, while Walmart is speeding up its service and testing innovations like in-home delivery. Kroger can’t keep pace with these two giants in terms of investment and sheer fulfillment muscle. But it could still be an innovator in omnichannel shopping — a key part of which is the store experience that is Foran’s forté.

Kroger needs to keep the growing number of digital shoppers inside its ecosystem. It can’t rely on shoppers seeking out its stores on Instacart and DoorDash, where grocers are interchangeable. AI-based shopping could further disintermediate retailers. As that technology’s influence continues to grow in back- and front-end operations, company leaders will need to be deft innovators as well as strong operators.

Can Foran — an old-school merchant who, according to Del Ray’s reporting, frequently clashed with Walmart’s e-commerce division — help Kroger navigate the increasingly complex digital landscape?

While it’s easy to criticize the recent moonshots that have come up short for Kroger, it’s important to remember what spurred these big swings in the first place. In order to stay relevant against giants like Walmart, Amazon, Costco and other competitors Kroger itself has highlighted as existential threats, the grocer needs more than just incremental change.

Only time will tell if Foran is up to that challenge.