Dive Brief:

- Albertsons believes investors undervalue its business and has launched an expanded share-repurchase program aimed at boosting its stock price, executives of the grocery company said during an earnings call Tuesday morning.

- The company recorded net sales of just over $18.9 billion during the second quarter of fiscal 2025, representing a year-over-year increase of 2%. Same-store sales rose 2.1%, a figure that Albertsons adjusted to 2.2% to reflect lost sales stemming from a strike by Safeway workers in Colorado that ended in early July.

- Albertsons has been examining the performance of its banners as it looks to “make very surgical decisions, strategic decisions, on how we can improve the fleet moving forward,” CEO Susan Morris said during the call.

Dive Insight:

Morris made clear during the earnings call that Albertsons is disappointed with how investors have been evaluating the chain’s operations in recent months, stressing that she has spent the time since she became CEO earlier this year focusing on unlocking growth opportunities.

To help boost its stock price, Albertsons plans to spend $750 million to repurchase shares in the company, an amount that is on top of the $2 billion the grocer said in December it would direct to stock buybacks in the aftermath of its failed effort to merge with Kroger.

“This reflects our conviction that our share price is very much underappreciated and does not fully reflect the strength of our foundation or the opportunities within our strategy to drive long-term shareholder value,” Morris said.

Investors reacted enthusiastically to the announcement, pushing up Albertsons’ share price by more than 11% Tuesday morning following the call. But even with that boost, Albertsons’ shares are still down in 2025, while Kroger’s stock price has increased.

Morris also suggested that Albertsons is contemplating expanding its operations by buying assets, noting that its decision to expand its share-buyback program would not preclude it from spending money on acquisitions, remodeling projects or investing in technology.

Albertsons said it expects to invest between $1.8 billion and $1.9 billion in capital expenditures during fiscal 2025.

“We are interested in growing in many ways, organically, but also … through acquisition. So we’ve left ourselves some room to be able to accomplish whatever we need, from a capital perspective, an acquisition perspective, or whatever else might come our way,” Morris said.

She added: “We’re a banner company built of acquisitions. It’s what we do. We’re very good at it, and looking for those strategic fill-ins is really important to us.”

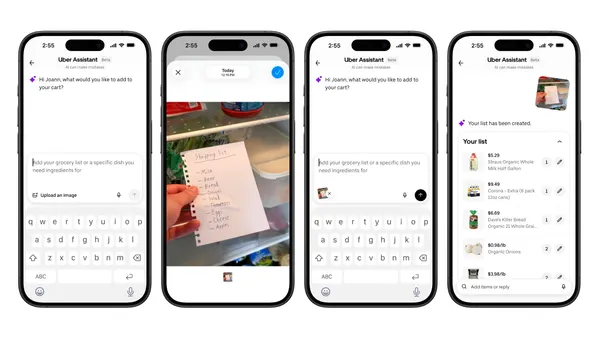

President and CFO Sharon McCollam said the company believes its store-based e-commerce fulfillment model gives it multiple advantages, including helping it to provide “the best and highest quality fresh product” while also driving efficiency.

“We actually believe that the winner in e-commerce would be in … who successfully delivered the best and highest quality fresh product in the last mile. And we built our e-commerce model with that in mind,” McCollam said.

Albertsons’ e-commerce business is moving closer to reaching a break-even point, she added. The company’s digital sales grew 23% year-over-year in Q2.

Albertsons’ owned real estate portfolio is valued at $14.3 billion, based on an appraisal the company conducted in July, Morris said. “These irreplaceable assets … are not only among the most valuable in retail but also operationally essential, supporting seamless customer access, optimized logistics and fueling long-term growth by placing us exactly where our customers live, shop and engage,” she said.

The company said its loyalty membership grew 13% during Q2, to 48.7 million members.

Albertsons said Tuesday that it boosted its full-year outlook for same-store sales growth and adjusted net income, reflecting its sense that investments in areas including its digital operations and retail media programs are poised to pay off.