Dive Brief:

- Albertsons generated $24.9 billion in net sales and other revenue during the first quarter of fiscal 2025, up 2.5% compared with the same period last year, the supermarket chain reported Tuesday.

- Identical sales moved ahead at a 2.8% clip, twice the rate it posted for the metric during Q1 of 2024, driven by double-digit growth in pharmacy and e-commerce sales.

- Albertsons raised its expectations for identical sales for the year, based in part on the assumption that its pharmacy and digital businesses will continue to grow, President and CFO Sharon McCollam said during an earnings call.

Dive Insight:

Albertsons has been directing resources toward its pharmacy and e-commerce operations, and those investments are paying off for the company, executives said during the earnings call.

The grocer has seen “sequential improvement” in its core grocery operations and believes that continued strength in that area will help push identical sales up as the year moves ahead, McCollam said. The company now expects identical sales to rise between 2% and 2.75% during fiscal 2025, up from the range of 1.5% to 2.5% it previously forecast.

Albertsons’ pharmacy and health business grew 20% year over year during Q1, due in part to robust prescription sales and immunization growth, said CEO Susan Morris, who took over the top job in May. That, in turn, is helping to increase sales elsewhere in the store.

People who make purchases at the pharmacy counter visit stores four times more often and buy significantly more groceries than other shoppers, Morris said, underscoring the long-term value for Albertsons of investing in that part of its business.

Morris added that Albertsons has found that GLP-1 drugs intended to help people lose weight have turned into sales drivers beyond the pharmacy counter despite the fact that the grocer does not make much money on the drugs themselves.

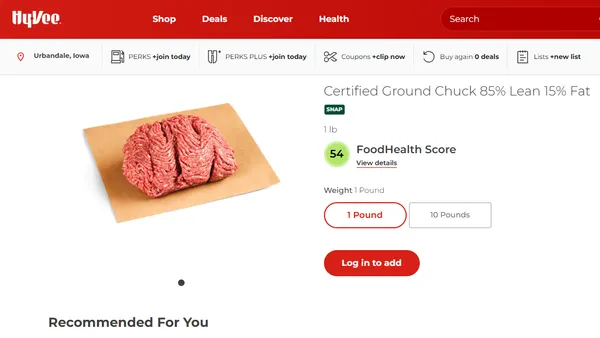

While shoppers who take those medications often decrease the size of their basket at the start, they typically start buying things like supplements and lean proteins, “categories that are actually quite profitable for us as a company,” Morris said.

During Q1, Albertsons saw 25% growth in digital sales, and e-commerce accounted for 9% of total grocery revenue, Morris said.

In response to a question from an analyst, McCollam said Albertsons is “getting very close” to breaking even on its e-commerce operations — a goal that Walmart has already achieved and Kroger is also pursuing.

McCollam emphasized that Albertsons does not take its Albertsons Media Collective digital media operation into account when evaluating the profitability of its e-commerce business, which she said differentiates it from competitors.

“From a financial point of view, of course, [e-commerce] creates data for the media collective, and it is a major provider of information for the media collective. But from a P&L point of view, it’s pure. What is driving that is volume, first and foremost,” McCollam said.

Morris also said during the call that Albertsons sees a strong growth path for its own brand business, noting that while private label penetration was nearly 26% during Q1, the company believes that figure should be at least 30%.