After a year filled with twists and turns, the grocery industry is gearing up for more commotion in 2026 as a challenging economic environment keeps squeezing consumers’ wallets.

Traditional grocers will continue to face rising competition, not only from retailers like Walmart and Amazon, but also from specialty grocers and discounters, who spent 2025 growing their foot traffic and emphasizing value.

Some key industry players spent 2025 regaining their footing. Kroger and Albertsons both had chaotic years as they implemented cost-cutting measures, closed stores and said goodbye to their longtime CEOs — all while suing each other over their mega-merger attempt, which fell apart at the end of 2024.

Amazon continued to push the envelope on the grocery front in 2025 and will likely stay on that trajectory in 2026 as the company refines its grocery efforts.

And while discounters seemed poised to soar amid consumer concerns over high food prices, tariffs and a controversial lapse in federal SNAP funds, their mixed performance throughout 2025 indicates that retailers like Grocery Outlet and Lidl have work ahead in 2026 to capitalize on a macroeconomic environment that should play to their strengths.

Here’s a look at eight trends that are likely to impact the grocery industry in 2026.

Grocers are facing even more acute economic challenges than they did in 2025

As grocers gear up for 2026, they will be confronting a series of economic challenges that could substantially impact the industry for several years, said Scott Mushkin, CEO of retail market research and advisory firm R5 Capital. Those trends include low population growth, which is poised to put downward pressure on demand for groceries, along with rising costs for basic expenses such as healthcare and insurance, which Mushkin said are eating into the budgets of consumers and businesses alike.

“Over the last 18 months, what we’ve been talking about is the have-to-haves of life have increased in price, and that they may be crowding out consumption,” Mushkin said, adding that many of these costs are only now beginning to show up because it takes time for inflationary pressures to ripple through the economy.

Capri Brixey, a partner at consultancy The Partnering Group, noted that grocers will need to concentrate on holding onto customers as people reduce the number of stores where they buy groceries.

“The game going forward is going to be less about increasing traffic for growth and more about retention of existing customers and building loyalty for growth, because if … trips consolidate, and if people are less willing to diversify their need sources, then they’re going to be willing to get more from one place,” said Brixey.

On top of those concerns, traditional supermarket operators face pressure from Amazon and Walmart in the advertising space, an area that retailers have been depending on to bolster their sales, Mushkin added.

“Amazon and Walmart's economic models are very different than the rest of the industry,” he said. “Amazon in particular, but Walmart, more and more — they’re just going to dwarf what the supermarkets can do.”

How will consumer-facing AI innovate?

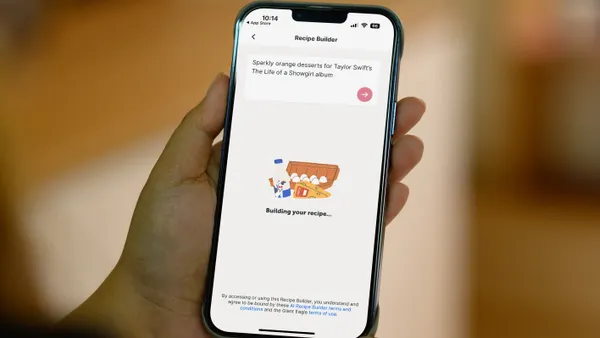

Consumer-facing artificial intelligence will continue to play an important role in the industry in 2026, but industry experts have different takes on how it will manifest.

Online product discovery is becoming increasingly popular and as grocers aim to offer a streamlined and frictionless experience for shoppers, they will likely bring AI onto their native platforms, according to Jessie Wright, vice president of product intelligence at data firm SPINS.

Bringing this technology to their own online marketplaces is a “direct reaction to shoppers wanting to be able to quickly find products and meet their personal preferences and health goals,” Wright said. “And these AI-powered solutions [are] able to capture the intent of the user, to better match products to the consumer.”

Stewart Samuel, director of retail futures at IGD, a retail market research firm, noted that while there is undoubtedly a demand for AI across the board and shoppers want more personalization, how AI will change the shopper experience is still a work in progress.

John Clear, a partner at AlixPartners, pointed out that AI is primarily used by younger consumers who have less spending power in the market. So while AI is something grocers should be prepared for, he’s not anticipating any “fundamental changes in the next year” as far as how AI is used and viewed.

Kroger heads into a pivotal year

The nation’s largest operator of conventional supermarkets is starting the new year with its future trajectory still uncertain.

A chief near-term question: who will the company name to replace Rodney McMullen, who left abruptly in early 2025, shortly after the merger plan fell apart? Under interim CEO Ron Sargent, Kroger has made progress toward addressing a range of issues that have held it back in recent years, Mushkin said.

“Everything we were concerned about, Ron is trying to fix,” Mushkin said. “Hopefully it’s not too late.”

Dialing down its dependence on automated fulfillment centers and refocusing on a store-focused e-commerce strategy, analysts said, will save money and allow it to devote resources to improving its fleet of supermarkets, they said.

“There's a lot of old Krogers at this stage,” Mushkin said.

Even as Kroger reduces its spending on robotic fulfillment technology, however, it is growing more dependent on its relationships with third-party e-commerce vendors like DoorDash, Instacart and Uber. While those arrangements extend Kroger’s reach to more shoppers, they put the company at risk of losing control over its ties with shoppers, said Tom Furphy, CEO and managing director of venture capital firm Consumer Equity Partners and former vice president of consumables and Amazon Fresh at Amazon.

“You need to have these [third-party] partnerships, but you really want to be careful to not hand the customer relationship over to these platforms,” he said.

Grocers will feel a greater impact from GLP-1s

As GLP-1 usage rises, industry consultants said they expect a shift in consumer spending as the appetite-suppressing medications impact users’ diets. Higher-protein foods are especially key to help people on these drugs maintain muscle mass and regulate their appetites.

Many smaller retailers are changing their floor plans to highlight higher-protein items in a bid to cater to GLP-1s users, said Anne Mezzenga, co-CEO of retail blog Omni Talk, which conducted interviews with several retailers during SpartanNash’s conference for regional grocers and brands this summer. Retailers are also putting refrigerated units housing protein drinks and yogurts in their checkout areas, Mezzenga said.

Numerator data from mid-2025 found that GLP-1 households outspend non-users by 25% on protein shakes and by 9% on protein water, meat and beans or grains — indicating grocers could see a sales bump from adding more protein options into their assortments and merchandising strategies.

In addition, trends in fiber consumption such as as “fibermaxing” — a practice that involves consuming a significant amount of fiber — that started in 2025 will likely continue into 2026, said Wright.

Mushkin added that the trend toward use of these drugs will be accelerated by the federal government’s decision to begin allowing Medicare to cover GLP-1 medications prescribed for weight loss.

Multicultural grocery is expected to grow

The same consumers and shopping behaviors that drove specialty grocers’ success in 2025 will likely fuel the rise of multicultural foods and international grocery chains in 2026, according to industry experts.

“[International grocers] are creating a path, because they offer the same things that are valued by natural and organic shoppers,” PDG Insights Principal and CEO Diana Leza Sheehan said in an interview. “They are offering another path that actually opens doors on cuisine for consumers.”

This trend isn’t limited to racially and ethnically diverse communities and consumers, Sheehan said. International grocers are opening in Alabama and central Ohio as grocers find ways to scale and operate profitably, often by expanding their assortment beyond one type of cuisine to appeal to diverse audiences.

Wright has also seen a rise in food and products from around the world as consumers seek out bold flavors. Already, this trend is reflected on shelves as well in new-to-market products. She noted that large CPGs are also likely in 2026 to disrupt large categories as they aim to meet consumer demand for global flavors.

The rise of small-scale and regional M&A

After the demise of the Kroger-Albertsons mega-merger, it’s unlikely the grocery industry will see any other national grocery companies try to combine. However, industry experts expect to see M&A activity continue among smaller and regional grocery chains.

Many regional grocers are in a tough spot as the industry experiences the “collapse of the middle,” Clear said, noting that regional players are losing “on both sides of the spectrum” as specialty and discount food retailers gain more wallet share.

This industry environment makes smaller chains “targets for M&A,” he said, giving a nod to the agreement by the Schnuck family, which runs Schnuck Markets, to buy the Wisconsin-based parent company of Skogen’s Festival Foods and Hometown Grocers, Inc.

“Regionals are under pressure, but I think the theme has been that those regionals who are closer to the bottom were not able to solidify their business during COVID and turn it around, and therefore they’ve been separated from the pack,” Clear said.

Bigger players’ involvement in M&A next year will primarily occur on a regional level, Clear added, in line with how Kroger and Albertsons have traditionally approached acquisitions.

Grocers will be more selective with innovation

As grocers navigate the challenging macroeconomic environment, they’ll likely take a cautious approach to rolling out new technologies, introducing niche brands and taking other innovative steps in 2026, sources said.

“Taking away space from established brands to give more room to innovative brands or innovation is probably not going to be their first move in a down economy or a risky or uncertain economy,” Brixey said, adding that consumers seeking niche or specialized brands may turn instead to DTC.

Which innovations will grocers go out on a limb for? Brixey thinks agentic AI technology will help retailers manage complex processes, noting that Walmart is already making investments in this area. Companies like Instacart that provide artificial intelligence technology to retailers also stand to gain, Brixey said.

“This seems like it's a really great time to be a grocery technology company, because unless you're Walmart or Amazon … [a company like] Instacart is there to say, ‘We have the package of services’” that retailers need, Brixey said.

Mezzenga said she expects computer vision-enabled inventory systems to shine as grocers look to streamline their inventory management and tap into the vast amounts of data that shelf-scanning robots can collect.

What is Amazon’s brick-and-mortar grocery strategy?

While Amazon continues to strengthen its already powerful presence in the grocery industry through online initiatives like its same-day perishables delivery business, the company is likely to face questions in 2026 about its ability to run brick-and-mortar stores, analysts said.

The company’s Amazon Fresh chain of brick-and-mortar supermarkets, which launched in 2020 and has undergone considerable upheaval since then, is a source of particular befuddlement, said Doug Munson, head of advisory services business development for retail intelligence provider RetailStat. Amazon has tried multiple strategies to help the chain’s stores resonate with shoppers, including positioning them as low-price leaders, but its stores still provide only a lackluster experience, according to analysts.

“In ’26, I think you're going to see Amazon make a decision on Amazon Fresh,” said Munson. “I just don’t see that they can go another year and [try] to find themselves. They’ve had plenty of time.”

In addition, Amazon’s strategy for its much larger Whole Foods Market chain remains fuzzy, raising questions about the company’s priorities for the specialty grocer, which it acquired in 2017.

Michael Infranco, assistant vice president of RetailStat, pointed to Whole Foods’ decision in late 2025 to offer conventional groceries at a store in Pennsylvania as an example of why the chain is sowing confusion in the industry.

“They really haven’t done a whole lot with Whole Foods to transform the industry. If anything, they’ve detracted from the Whole Foods brand,” said Infranco.

Furphy agreed that the company has yet to demonstrate that its prowess online extends to its store-operations capabilities. Instead, Amazon is poised to make a major splash with its same-day perishables distribution program, which it recently expanded to 2,300 markets around the U.S., he said.

“I think you’re going to continue to see tweaking around Whole Foods and getting those customers to buy the [full] range of products,” Furphy said. “Their big bet is on their same-day grocery delivery … that is going to be a big share grabber.”