As the grocery industry continues to weather economic uncertainty, retailers are pushing forward with efforts to improve their value and pricing reputations with consumers as they enter the second half of 2025. Disruption with distributors — from a major acquisition to changes in how retailers source goods — was a main theme throughout the first half of the year.

Among the many top-level executive changes at grocery companies this year, who will step into the top seat at Kroger is one of the most anticipated C-suite developments for not just the grocery juggernaut but the industry as a whole.

Here are seven big questions we’ll be keeping a close eye on through the end of 2025.

What will happen with tariffs and how will they impact grocers?

After several months of dizzying changes regarding tariffs, it doesn’t appear U.S. grocers will be out of the woods anytime soon when it comes to the potential impacts of international trade deals and levies.

As grocers have grappled with threatened and implemented tariffs since the spring, some have eyed diversifying their sourcing to weather supply chain challenges, while others have looked to pass along tariff-related costs to suppliers. Meanwhile, Walmart has looked to boost its price positioning amid the retailer’s concerns that tariffs could drive up prices on certain goods.

Over the last few weeks, it’s become clear that the potential impacts of tariffs won’t impact grocers equally. Grocers with high percentages of imported goods making up their assortments, such as Asian supermarkets, will likely take a harder hit than retailers with the flexibility to switch where they get their goods from.

How the trade battles play out in the coming weeks could greatly affect grocers’ plans for holiday sourcing.

Who will be Kroger’s next CEO?

Rodney McMullen’s departure from Kroger’s helm shocked the industry — especially considering he left following an ethics investigation. His 11-year career as the grocer’s CEO ended back in early March when Kroger’s board found McMullen’s personal conduct “inconsistent” with its ethics policy.

Since then, Kroger’s executive shuffling hasn’t ceased. This year alone, the company has announced around a dozen changes to its corporate ranks, including onboarding David Kennerley to serve as CFO, naming Yael Cosset to EVP and chief digital officer, and promoting Rudy DiPietro to helm the newly consolidated Dallas and Houston divisions.

McMullen’s sudden exit has also caught the attention of competitors, primarily Albertsons. As the two companies continue their legal battles over their failed bid to merge, Albertsons is trying to compel Kroger to divulge McMullen’s potentially unethical conduct.

As Kroger searches for a new leader, the company has tapped Lead Director Ronald Sarget to serve as chairman of the board of directors and as interim CEO. Despite a bevy of executive changes, there has been no word yet from the company on who will step in as the next CEO.

How will loyalty programs continue to evolve?

The name of the grocery industry game is “loyalty,” and grocers are bending over backwards to prove to consumers that they, too, care about high prices. And though loyalty programs are nothing new, finding ways to make them effective for communicating with shoppers both in-store and online is no easy task.

Sprouts has garnered a lot of attention recently around the rollout of its inaugural loyalty program. Specialty grocers have focused on their curated selections to drive repeat visits, and a loyalty program offers the opportunity to deepen ties with health and wellness-focused shoppers.

Loyalty memberships can also be a way for small and mid-sized grocery players to win back Walmart e-grocery shoppers, Brick Meets Click noted in their April 2025 report sponsored by Mercatus.

“[L]asting loyalty forms where speed, control, and value meet,” Mark Fairhurst, chief growth marketing officer for Mercatus, said in a statement, adding that for loyalty programs to evolve, they need to meet consumers’ in-store and online shopping needs.

How much more price sensitive will consumers get?

Food-at-home inflation hit an all-time high in 2022 following the height of the COVID-19 pandemic, and while inflation has come down since then, consumers remain very price sensitive. A recent consumer poll from The Associated Press found that more than half of respondents said grocery prices are a major source of stress.

In response, grocers are testing new ways to prove to shoppers that value comes first. Examples from just this summer include Kroger offering its Boost members more than $100 in savings during a two-week stretch and Stop & Shop launching a new campaign aimed at reinforcing value.

But if price sensitivity persists, grocers’ usual bag of tricks may not be sufficient in easing consumers’ concerns. Recent reports are underscoring that yellow discount stickers aren’t making consumers feel better. The Feedback Group reported in June that consumers want their supermarkets to provide explanations around high prices, specifically when it comes to tariff impacts.

The Kearney Consumer Institute recently released a report noting that shoppers don’t want grocers to echo their economic anxieties, but rather help them discover new food and beverages.

How will distribution evolve?

Sprouts Farmers Market told investors earlier this year that it is expanding its self-distribution network to bring its fresh meat and seafood sourcing in-house.

The grocer is not the first to do so. Ahold Delhaize, which has ADUSA Distribution as well as ADUSA Transportation to serve its stateside banners, began self-distributing in the U.S. in 2019. Walmart recently opened its first owned-and-operated case-ready beef facility and has plans to debut a milk processing facility in Valdosta, Georgia. Costco has had in-house poultry production for years.

But Sprouts’ self-distribution push could signal that in-sourcing is not just for the major national players who benefit from scale or for small independents with strong local ties, but also for regionals.

Major distributors have gone through significant upheaval this year. United Natural Foods, Inc., battled a cyberattack that left grocers scrambling and underscored their reliance on large wholesalers, while C&S announced a plan to acquire SpartanNash that could impact grocery supply dynamics across the U.S.

Could more medium-sized grocers follow Sprouts in ramping up their in-sourcing efforts to gain more control over their supply chains? Given tariff uncertainty and domestic sourcing opportunities, categories like fresh foods seem like ripe opportunities for supermarkets to explore for self-distribution.

Where does AI fall as a priority?

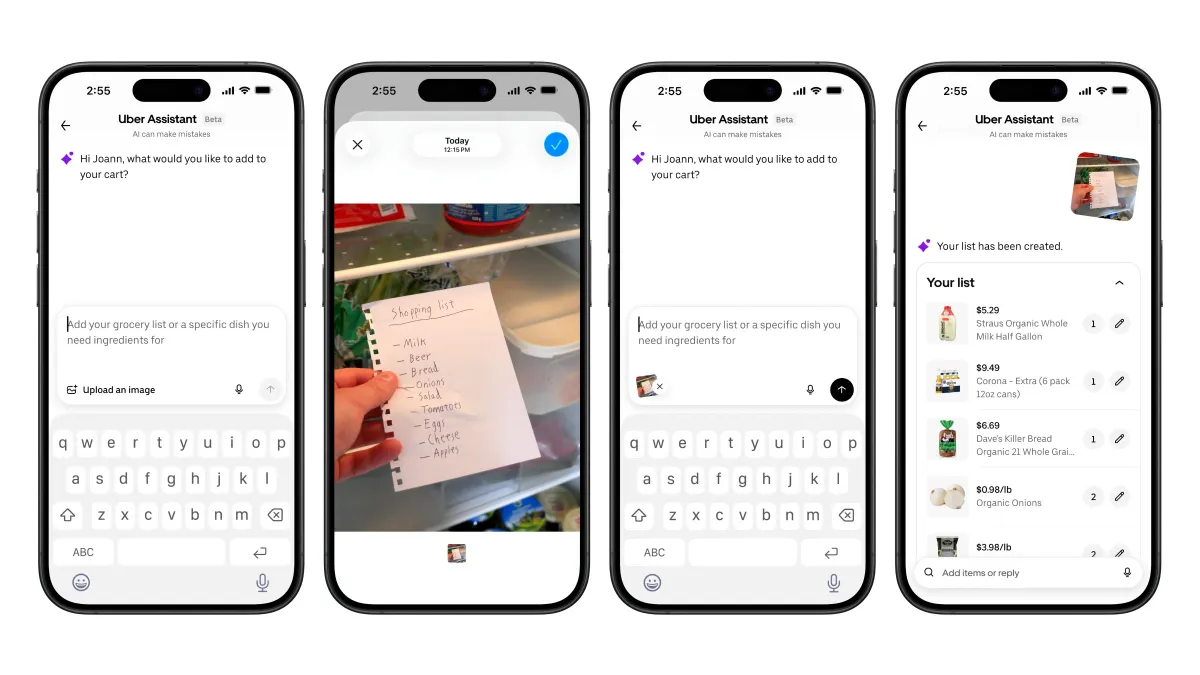

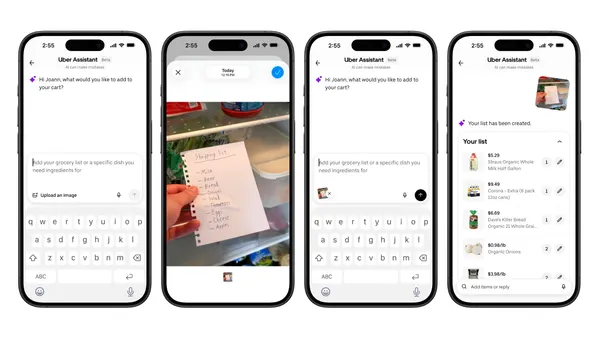

Artificial intelligence is cropping up more and more in grocery, whether to boost operational efficiency or to create a more streamlined customer-facing experience.

Instacart has ramped up its use of AI to improve its product replacements and to tag products in its catalog to allow for greater personalization with dietary preferences.

Albertsons also discussed AI during its April earnings call, stating it is strengthening its data science capabilities as it expands AI adoption and aims for productivity improvements.

AI will be the main topic of conversation during a number of sessions at this year’s Groceryshop conference. But much remains unknown in terms of new ways of prioritizing AI during the second half of 2025.

Will grocers put more safety nets around their supply chain operations?

The fallout from the cyberattack that impacted UNFI’s operations in June was the latest reminder to grocers that flexibility is a key element to a successful supply chain. While some grocers quickly pivoted to other suppliers for goods that UNFI couldn’t provide while its systems were down, others struggled with sourcing — resulting in barren shelves for consumers.

Just a few months prior, Ahold Delhaize got hit with a cyberattack that not only hurt online and in-person sales for several of its stateside banners but also compromised worker data.

These recent incidents have highlighted the importance of robust inventory management so that buyers and suppliers can efficiently identify issues, as well as the need for strong cybersecurity to protect company data. With these warnings, how long will it take grocers to take heed and boost the firewalls around their supply chain operations?